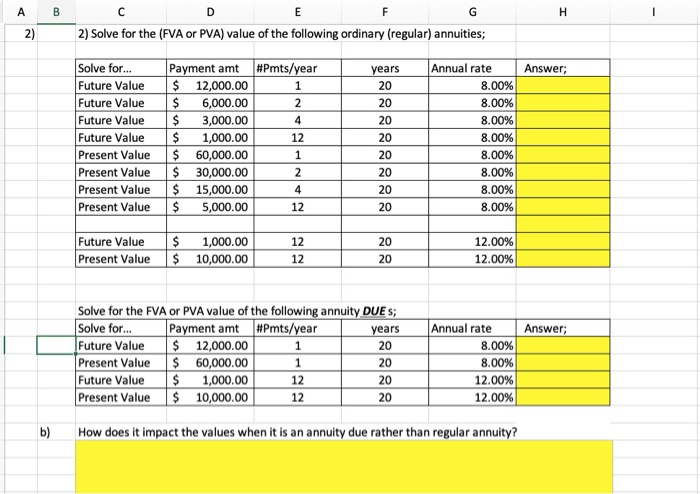

Question: How to solve in excel? - B G H 2) D E F 2) Solve for the (FVA or PVA) value of the following ordinary

- B G H 2) D E F 2) Solve for the (FVA or PVA) value of the following ordinary (regular) annuities; Answer; Solve for... Future Value Future Value Future Value Future Value Present Value Present Value Present Value Present Value Payment amt #Pmts/year $ 12,000.00 1 $ 6,000.00 2 $ 3,000.00 4 $ 1,000.00 12 $ 60,000.00 1 $ 30,000.00 2 $ 15,000.00 4 $ 5,000.00 12 years 20 20 20 20 20 20 20 Annual rate 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 20 Future Value $ 1,000.00 Present Value $ 10,000.00 12 12 20 20 12.00% 12.00% Answer; Solve for the FVA or PVA value of the following annuity DUE S; Solve for... Payment amt #Pmts/year years Future Value $ 12,000.00 1 20 Present Value $ 60,000.00 1 20 Future Value $ 1,000.00 12 20 Present Value $ 10,000.00 12 20 Annual rate 8.00% 8.00% 12.00% 12.00% b) How does it impact the values when it is an annuity due rather than regular annuity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts