Question: how to solve it step by step? 34. Kevin Klein owns 900 shares of Palmer Corp. stock which he purchased three years ago for $65

how to solve it step by step?

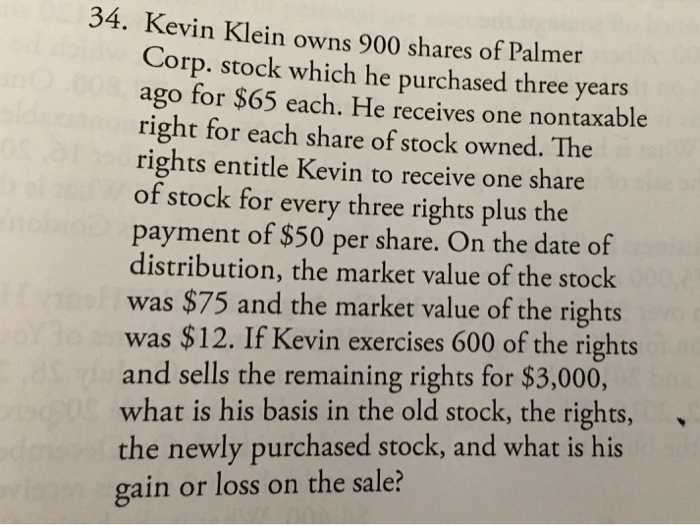

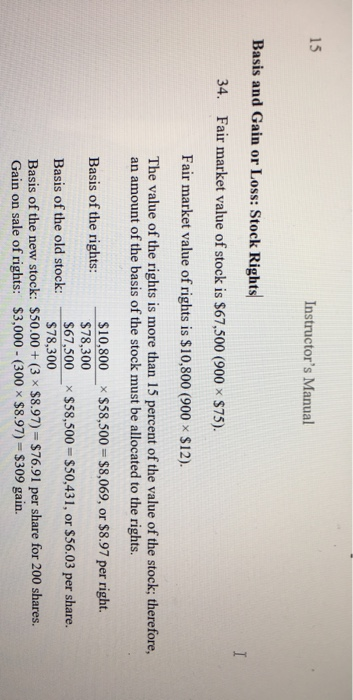

34. Kevin Klein owns 900 shares of Palmer Corp. stock which he purchased three years ago for $65 each. He receives one nontaxable right for each share of stock owned. The rights entitle Kevin to receive one share of stock for every three rights plus the payment of $50 per share. On the date of distribution, the market value of the stock was $75 and the market value of the rights was $12. If Kevin exercises 600 of the rights and sells the remaining rights for $3,000, what is his basis in the old stock, the rights, the newly purchased stock, and what is his or loss on the sale? a gain 15 Instructor's Manual Basis and Gain or Loss: Stock Rights I 34. Fair market value of stock is $67,500 (900 x $75) Fair market value of rights is $10,800 (900 x $12). The value of the rights is more than 15 percent of the value of the stock; therefore, an amount of the basis of the stock must be allocated to the rights. $10,800 x $58,500 $8,069, or $8.97 per right. X Basis of the rights: $78,300 $67,500 $78,300 x $58,500 $50,431, or $56.03 per share. Basis of the old stock: Basis of the new stock: $50.00+(3 x $8.97) $76.91 per share for 200 shares. Gain on sale of rights: $3,000- (300 x $8.97) $309 gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts