Question: How to solve Modigliani & Miller Propositions NoLeverage is a firm financed entirely with equity and Leverage is a firm financed with 5 0 -

How to solve

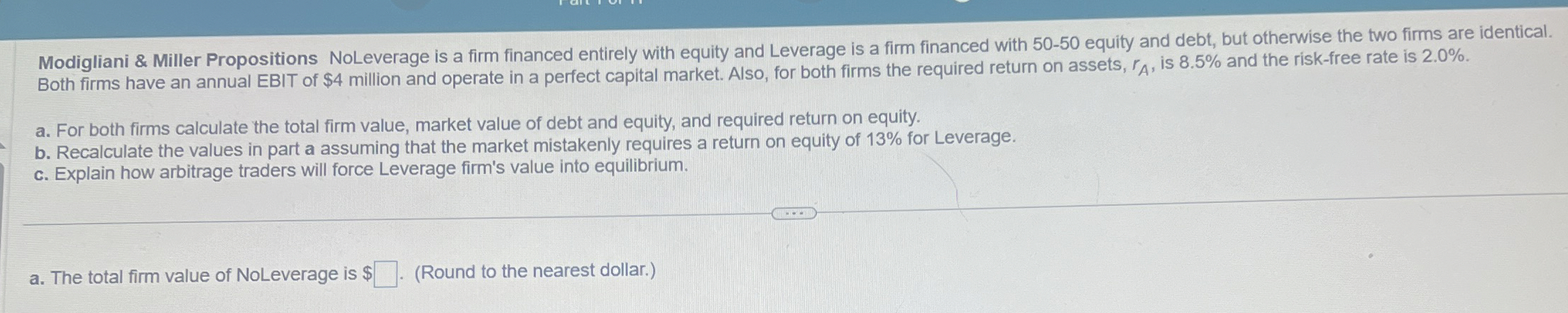

Modigliani & Miller Propositions NoLeverage is a firm financed entirely with equity and Leverage is a firm financed with equity and debt, but otherwise the two firms are identical. Both firms have an annual EBIT of $ million and operate in a perfect capital market. Also, for both firms the required return on assets, is and the riskfree rate is

a For both firms calculate the total firm value, market value of debt and equity, and required return on equity.

b Recalculate the values in part a assuming that the market mistakenly requires a return on equity of for Leverage.

c Explain how arbitrage traders will force Leverage firm's value into equilibrium.

a The total firm value of NoLeverage is $ Round to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock