Question: How to solve part e iii), f, g? Two (default-free) government bonds, A and B, are trading at a current market price of $80 and

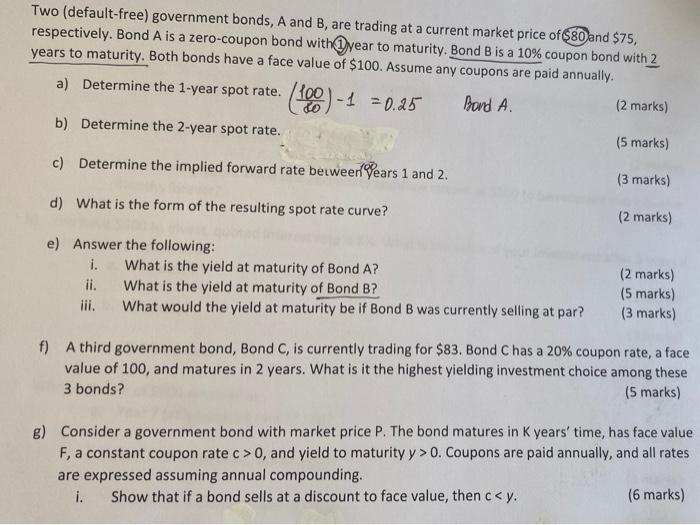

Two (default-free) government bonds, A and B, are trading at a current market price of $80 and $75, respectively. Bond A is a zero-coupon bond with 1yyear to maturity. Bond B is a 10% coupon bond with 2 years to maturity. Both bonds have a face value of $100. Assume any coupons are paid annually. a) Determine the 1 -year spot rate. (d0100)1=0.25 Bond A. (2 marks) b) Determine the 2-year spot rate. (5 marks) c) Determine the implied forward rate between 9 ears 1 and 2 . (3 marks) d) What is the form of the resulting spot rate curve? ( 2 marks) e) Answer the following: i. What is the yield at maturity of Bond A? ii. What is the yield at maturity of Bond B? (2 marks) iii. What would the yield at maturity be if Bond B was currently selling at par? ( 3 marks) f) A third government bond, Bond C, is currently trading for $83. Bond C has a 20% coupon rate, a face value of 100, and matures in 2 years. What is it the highest yielding investment choice among these 3 bonds? (5 marks) g) Consider a government bond with market price P. The bond matures in K years' time, has face value F, a constant coupon rate c>0, and yield to maturity y>0. Coupons are paid annually, and all rates are expressed assuming annual compounding. i. Show that if a bond sells at a discount to face value, then c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts