Question: How to solve problem 2.16? 2.156. EUAC calculations involving a uniform gradient Air pollution control device A has a total capital investment of $50,000, an

How to solve problem 2.16?

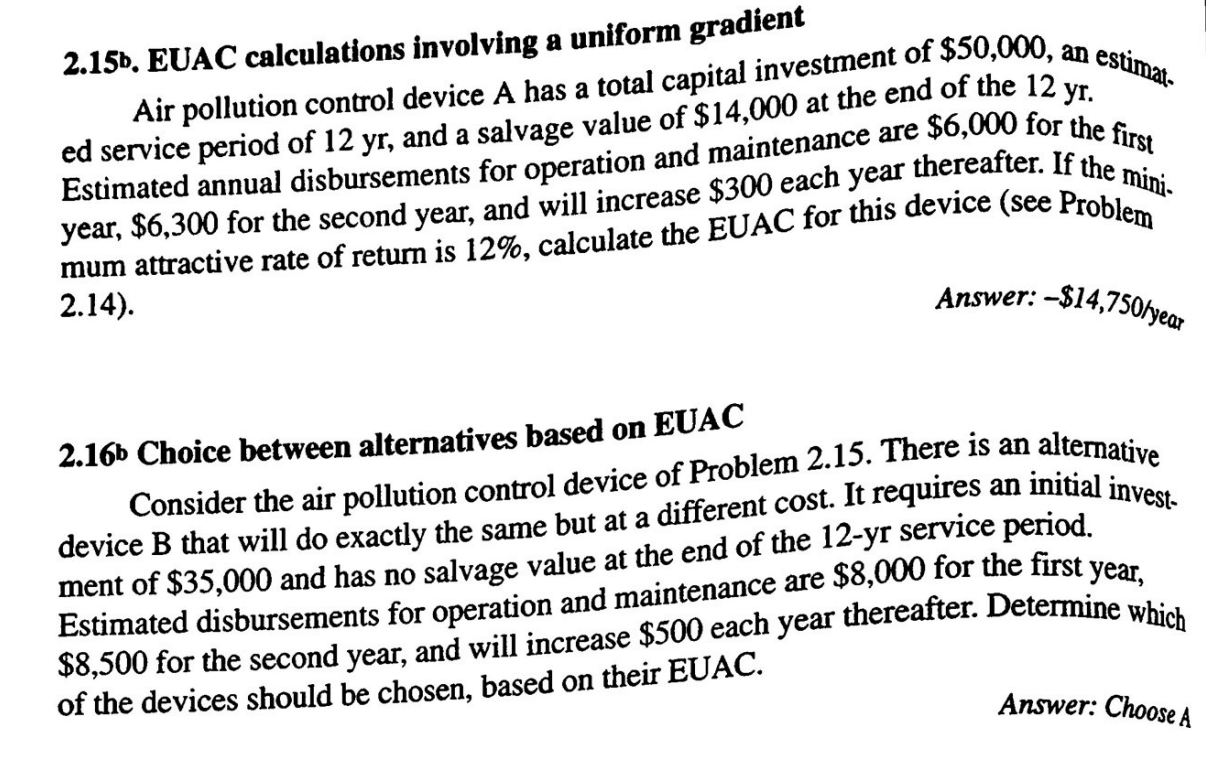

2.156. EUAC calculations involving a uniform gradient Air pollution control device A has a total capital investment of $50,000, an estimat. ed service period of 12 yr, and a salvage value of $14,000 at the end of the 12 yr. Estimated annual disbursements for operation and maintenance are $6,000 for the first year, $6,300 for the second year, and will increase $300 each year thereafter. If the mini- mum attractive rate of return is 12%, calculate the EUAC for this device (see Problem 2.14). Answer: -$14,750/year alternative 2.166 Choice between alternatives based on EUAC Consider the air pollution control device of Problem 2.15. There is an device B that will do exactly the same but at a different cost. It requires an initial invest- ment of $35,000 and has no salvage value at the end of the 12-yr service period. Estimated disbursements for operation and maintenance are $8,000 for the first year, $8,500 for the second year, and will increase $500 each year thereafter. Determine which of the devices should be chosen, based on their EUAC. Answer: Choose A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts