Question: How to solve QUESTION 3 The Assignwell Bhd . ' s present capital structure has been determined as follows: The CEO of Assignwell Bhd .

How to solve

QUESTION

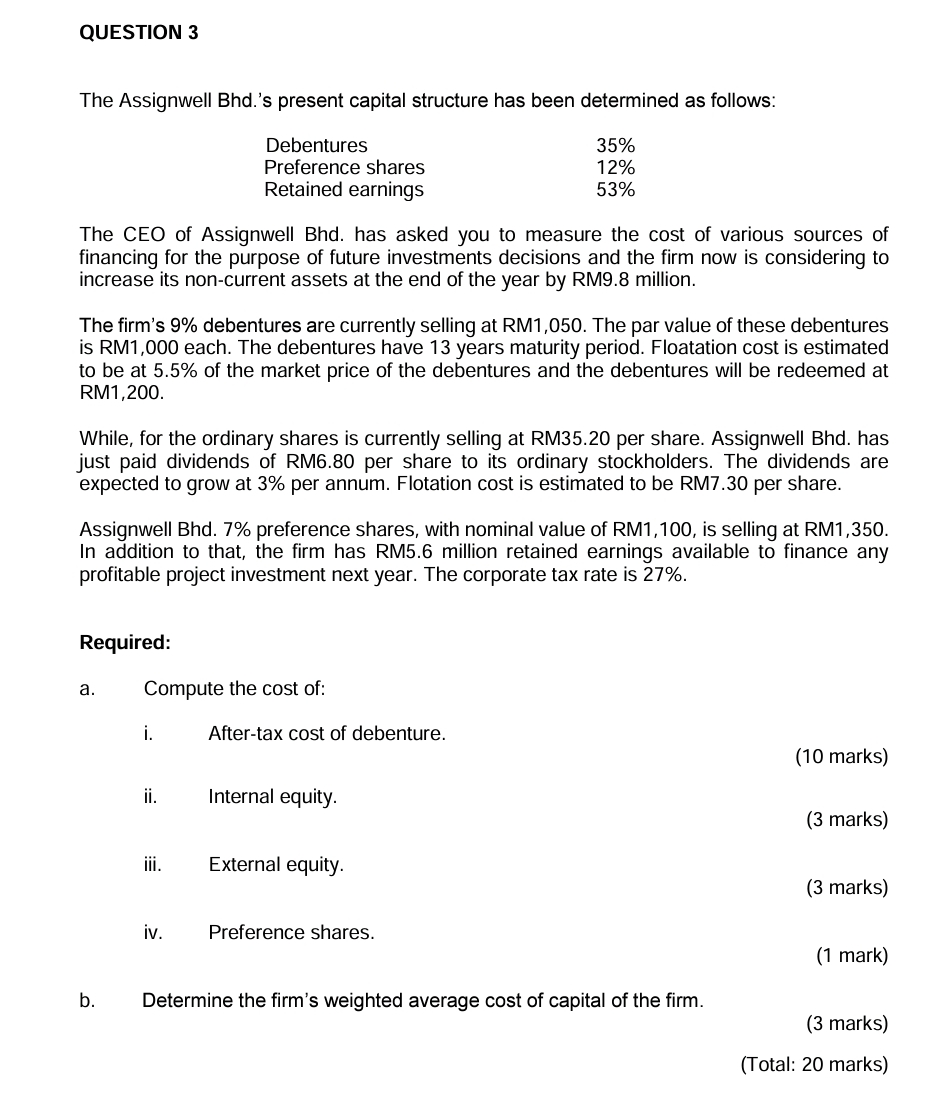

The Assignwell Bhds present capital structure has been determined as follows:

The CEO of Assignwell Bhd has asked you to measure the cost of various sources of

financing for the purpose of future investments decisions and the firm now is considering to

increase its noncurrent assets at the end of the year by RM million.

The firm's debentures are currently selling at RM The par value of these debentures

is RM each. The debentures have years maturity period. Floatation cost is estimated

to be at of the market price of the debentures and the debentures will be redeemed at

RM

While, for the ordinary shares is currently selling at RM per share. Assignwell Bhd has

just paid dividends of RM per share to its ordinary stockholders. The dividends are

expected to grow at per annum. Flotation cost is estimated to be RM per share.

Assignwell Bhd preference shares, with nominal value of RM is selling at RM

In addition to that, the firm has RM million retained earnings available to finance any

profitable project investment next year. The corporate tax rate is

Required:

a Compute the cost of:

i Aftertax cost of debenture.

marks

ii Internal equity.

marks

iii. External equity.

marks

iv Preference shares.

b Determine the firm's weighted average cost of capital of the firm.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock