Question: How to solve question 4 : Please show the step and calculation The central warehouse of a large manufacturer of heavy machinery and engines stocks

How to solve question : Please show the step and calculation

The central warehouse of a large manufacturer of heavy machinery and engines stocks three different engine oil

products. The central warehouse orders these three products from the company's manufacturing operations

division and stocks them to meet demands of the company's dealers, which serve customer demand for these

engine oil products. The lead time and fixed order costs are about the same for each order, regardless of the

quantity or product type ordered; it is safe to assume that lead time is about one month and fixed order costs

are $ per order.

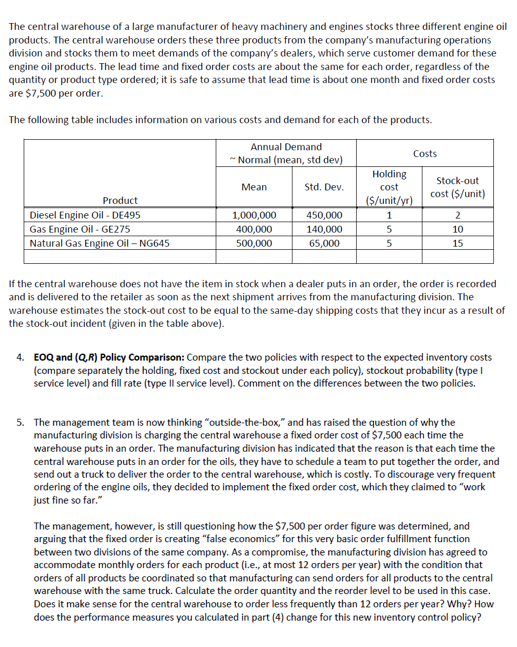

The following table includes information on various costs and demand for each of the products.

If the central warehouse does not have the item in stock when a dealer puts in an order, the order is recorded

and is delivered to the retailer as soon as the next shipment arrives from the manufacturing division. The

warehouse estimates the stockout cost to be equal to the sameday shipping costs that they incur as a result of

the stockout incident given in the table above

EOQ and QR Policy Comparison: Compare the two policies with respect to the expected inventory costs

compare separately the holding, fixed cost and stockout under each policy stockout probability type I

service level and fill rate type II service level Comment on the differences between the two policies.

The management team is now thinking "outsidethebox," and has raised the question of why the

manufacturing division is charging the central warehouse a fixed order cost of $ each time the

warehouse puts in an order. The manufacturing division has indicated that the reason is that each time the

central warehouse puts in an order for the oils, they have to schedule a team to put together the order, and

send out a truck to deliver the order to the central warehouse, which is costly To discourage very frequent

ordering of the engine oils, they decided to implement the fixed order cost, which they claimed to "work

just fine so far."

The management, however, is still questioning how the $ per order figure was determined, and

arguing that the fixed order is creating "false economics" for this very basic order fulfillment function

between two divisions of the same company. As a compromise, the manufacturing division has agreed to

accommodate monthly orders for each product ie at most orders per year with the condition that

orders of all products be coordinated so that manufacturing can send orders for all products to the central

warehouse with the same truck. Calculate the order quantity and the reorder level to be used in this case.

Does it make sense for the central warehouse to order less frequently than orders per year? Why? How

does the performance measures you calculated in part change for this new inventory control policy?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock