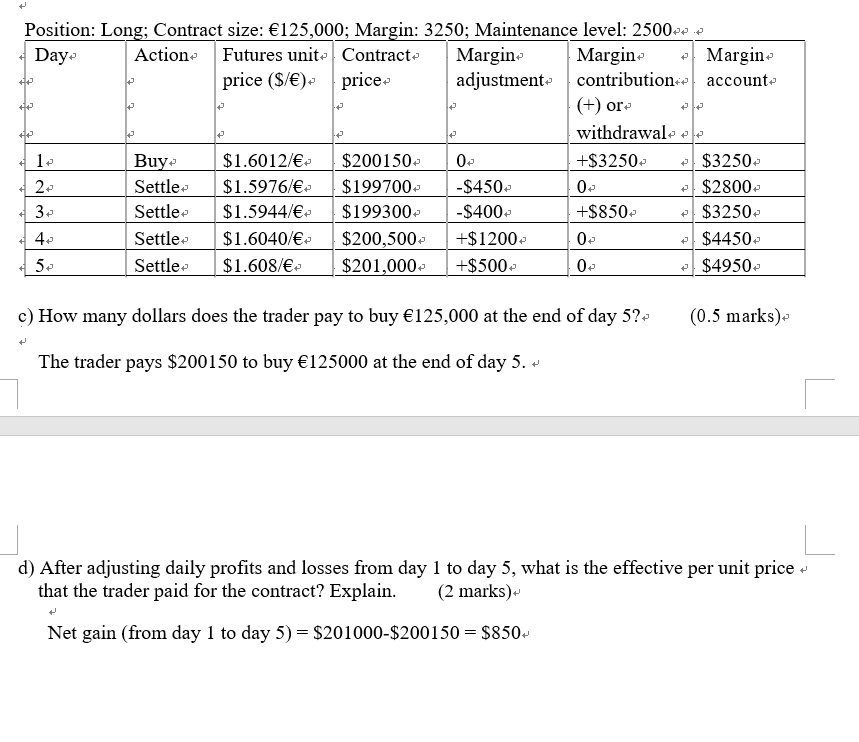

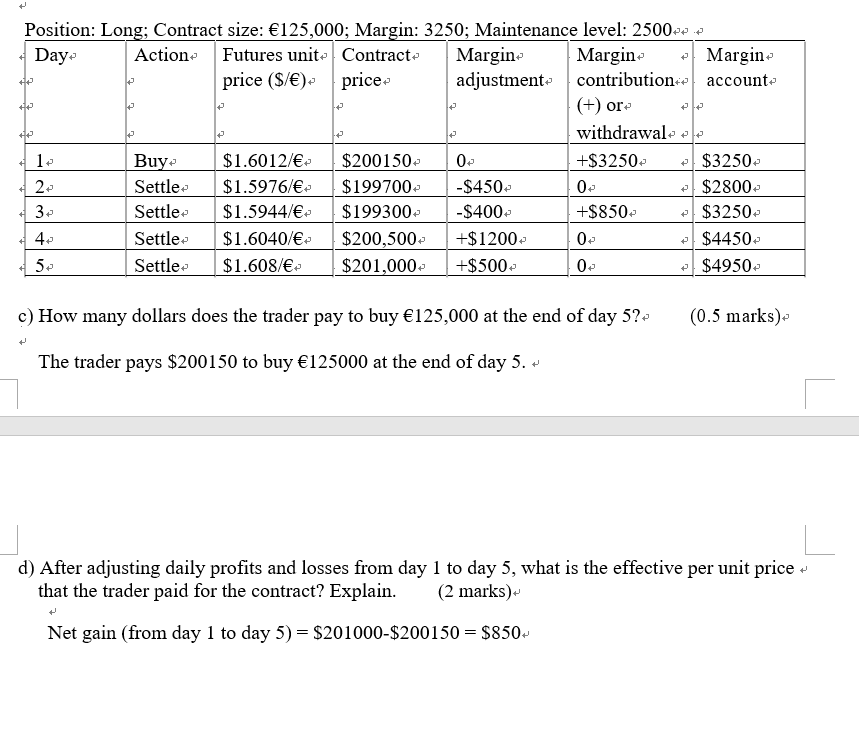

Question: How to solve question d? Explain your answer. ...................................................... I Position: Long; Contract size: 125,000; Margin: 3250; Maintenance level: 25004343 4: Dayu Action: Futures unite

How to solve question d? Explain your answer. ......................................................

I Position: Long; Contract size: 125,000; Margin: 3250; Maintenance level: 25004343 4: Dayu Action: Futures unite Contract: Margina Marginu .: Marginu price (ME): price: adjustment: contributionw account.: ,3 ,3 +3 (+) on: J 4: .: .: .: withdrawalu .: .: B 4: $1.6012a': 332001500 (L: +$32504 a $3250: 10 $1.5976f.: $199701 $1.5944fu 331993000 4+: Settle: $ 1 .604016: $200,500: +$1200o 0: +: $4450: 5.: Settlee: $ 1 .60 81%.: $201 000.: +$500: 0.: : $4950.: c) How many dollars does the trader pay to buy 125,000 at the end of dayr 51%: (0.5 marks}: .J The trader pays $200150 to buy 125000 at the end of day 5. v 7 V J L d) Aer adjusting daily.r prots and losses from day 1 to day 5, what is the effective per unit price 4: that the trader paid for the contract? Explain. (2 marks): y Net gain (from dayr 1 to day 5) = $201m$200150 = $350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts