Question: how to solve that question?? A BBB-rated corporate bond has a yield to maturity of 13.5%. AU.S. treasury security has a yield to maturity of

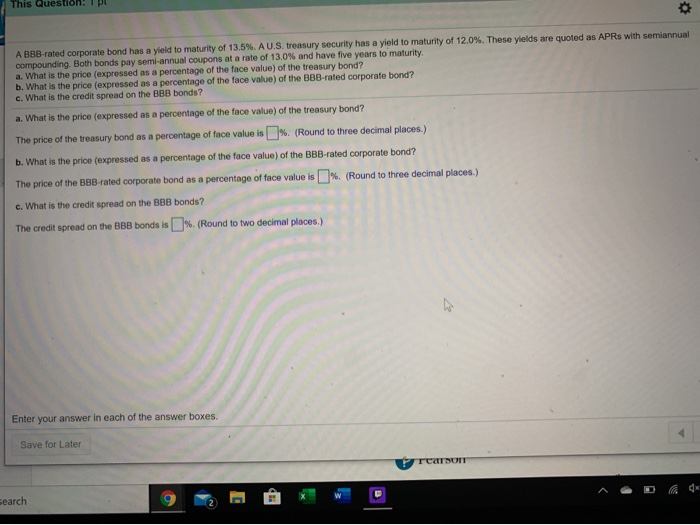

A BBB-rated corporate bond has a yield to maturity of 13.5%. AU.S. treasury security has a yield to maturity of 12.0%. These yields are quoted as APRs with semiannual compounding. Both bonds pay semi-annual coupons at a rate of 13.0% and have five years to maturity a. What is the price (expressed as a percentage of the face value) of the treasury bond? b. What is the price (expressed as a percentage of the face value) of the BBB-rated corporate bond? c. What is the credit spread on the BBB bonds? a. What is the price (expressed as a percentage of the face value) of the treasury bond? The price of the treasury bond as a percentage of face value is %. (Round to three decimal places.) b. What is the price (expressed as a percentage of the face value) of the BBB-rated corporate bond? The price of the B88-rated corporate bond as a percentage of face value is %. (Round to three decimal places.) c. What is the credit spread on the BBB bonds? The credit spread on the BBB bonds is %. (Round to two decimal places.) Enter your answer in each of the answer boxes. Save for Later earch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts