Question: How to solve the question (b) and (c) about the yield and I don't know how to calculator the future value of interest payment. suppose

How to solve the question (b) and (c) about the yield and I don't know how to calculator the future value of interest payment.

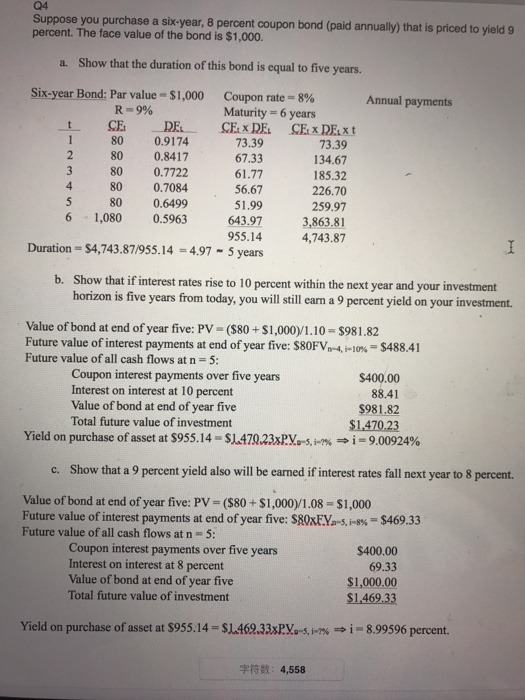

How to solve the question (b) and (c) about the yield and I don't know how to calculator the future value of interest payment. suppose you purchase a six-year, 8 percent coupon bond (paid annually) that is priced to yield 9 percent. The face value of the bond is $1,000. a. show that the duration of this bond is equal to five years. Six-year Bond: Par value $1,000 Coupon rate-8% Annual payments Maturity 6 years CE, 80 0.9174. 73.39 73.39 2 80 0.8417 67.33 134.67 80 0.7722 61.77 185.32 80 0.7084 56.67 226.70 5 80 0.6499 51.99 259.97 6 1,080 0.5963 643.9 3,863.8 955.14 4,743.87 Duration-$4,743.87/955.14-4 97 5 years b. show that if interest rates rise to 10 percent within the next year and your investment horizon is five years from today, you will still earn a 9 percent yield on your investment. Value of bond at end of year five: Pv ($80 $1,000) 1.10 $981.82 Future value of interest payments at end of year five: $80Fvn 4. 10% $488.41 Future value of all cash flows at n-5: Coupon interest payments over five years S400.00 Interest on interest at 10 percent 88.41 Value of bond at end of year five $981.82 Total future value of investment Yield on purchase of asset at s955.14 $us47023xPyo i 9.00924% c. Show that a 9 percent yield also will be earned if interest rates fall next year to 8 percent. Value of bond at end ofyear five: PV (s80 $1,000W1.08 $1,000 Future value of interest payments at end of year five: s80xEYa-s, S469.33 Future value of all cash flows at n 5: Coupon interest payments over five years S400.00 Interest on interest at 8 percent 69.33 Value of bond at end of year five $1,000.00 Total future value of investment Yield on purchase of asset at $955.14-$1.46933sPyo i-m6- i-8.99596 percent. 13R: 4,558

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts