Question: how to solve them using a financial calculator? please show the answers step by step 33. The GMP Corporation issued a new series of bonds

how to solve them using a financial calculator? please show the answers step by step

how to solve them using a financial calculator? please show the answers step by step

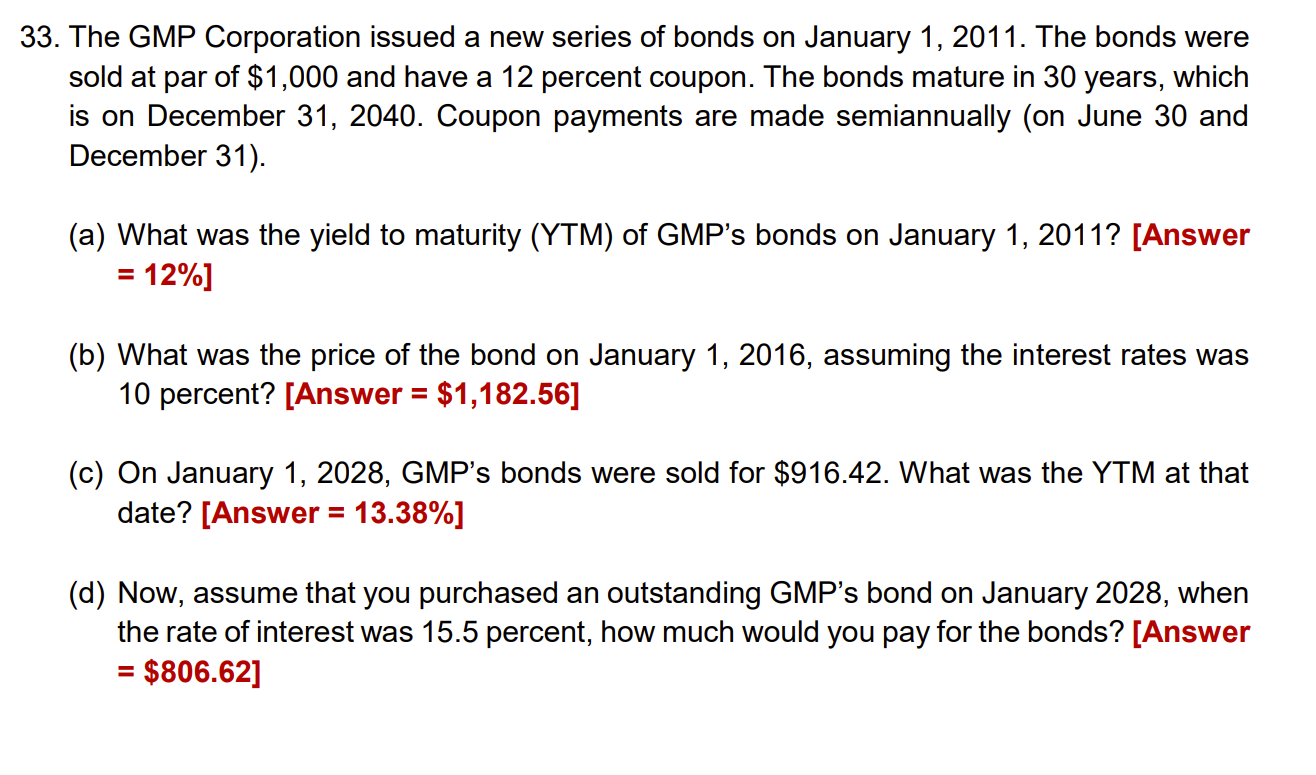

33. The GMP Corporation issued a new series of bonds on January 1,2011 . The bonds were sold at par of $1,000 and have a 12 percent coupon. The bonds mature in 30 years, which is on December 31, 2040. Coupon payments are made semiannually (on June 30 and December 31). (a) What was the yield to maturity (YTM) of GMP's bonds on January 1, 2011? [Answer =12%] (b) What was the price of the bond on January 1,2016 , assuming the interest rates was 10 percent? [ Answer =$1,182.56] (c) On January 1, 2028, GMP's bonds were sold for $916.42. What was the YTM at that date? [ Answer =13.38%] (d) Now, assume that you purchased an outstanding GMP's bond on January 2028, when the rate of interest was 15.5 percent, how much would you pay for the bonds? [Answer =$806.62]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts