Question: HOW TO SOLVE these four ( the choices are save) Under each scenario, please report how much Gain or Loss is incurred in the problem

HOW TO SOLVE these four ( the choices are save)

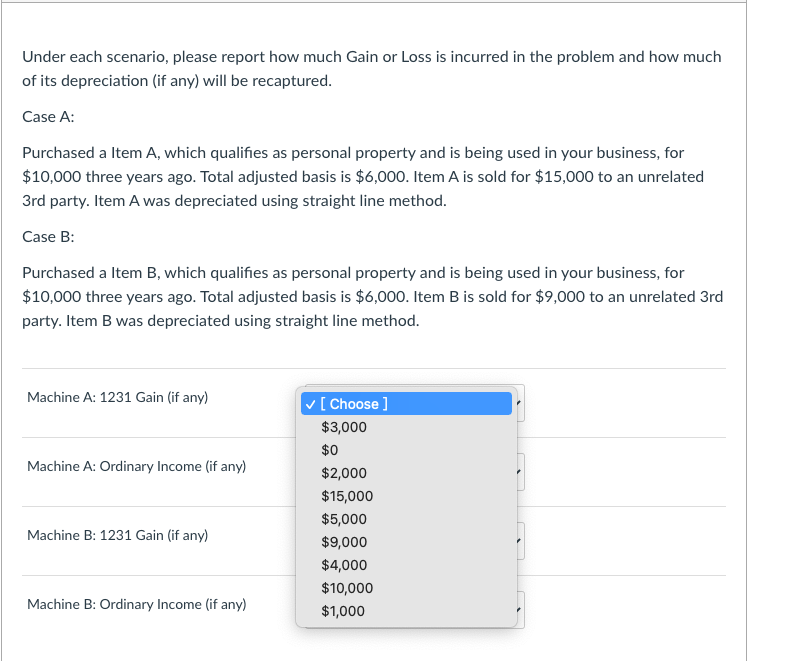

Under each scenario, please report how much Gain or Loss is incurred in the problem and how much of its depreciation (if any) will be recaptured. Case A: Purchased a Item A, which qualifies as personal property and is being used in your business, for $10,000 three years ago. Total adjusted basis is $6,000. Item A is sold for $15,000 to an unrelated 3rd party. Item A was depreciated using straight line method. Case B: Purchased a Item B, which qualifies as personal property and is being used in your business, for $10,000 three years ago. Total adjusted basis is $6,000. Item B is sold for $9,000 to an unrelated 3rd party. Item B was depreciated using straight line method. Machine A: 1231 Gain (if any) Machine A: Ordinary Income (if any) [Choose ] $3,000 $0 $2,000 $15,000 $5,000 $9,000 $4,000 $10,000 $1,000 Machine B: 1231 Gain (if any) Machine B: Ordinary Income (if any) Under each scenario, please report how much Gain or Loss is incurred in the problem and how much of its depreciation (if any) will be recaptured. Case A: Purchased a Item A, which qualifies as personal property and is being used in your business, for $10,000 three years ago. Total adjusted basis is $6,000. Item A is sold for $15,000 to an unrelated 3rd party. Item A was depreciated using straight line method. Case B: Purchased a Item B, which qualifies as personal property and is being used in your business, for $10,000 three years ago. Total adjusted basis is $6,000. Item B is sold for $9,000 to an unrelated 3rd party. Item B was depreciated using straight line method. Machine A: 1231 Gain (if any) Machine A: Ordinary Income (if any) [Choose ] $3,000 $0 $2,000 $15,000 $5,000 $9,000 $4,000 $10,000 $1,000 Machine B: 1231 Gain (if any) Machine B: Ordinary Income (if any)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts