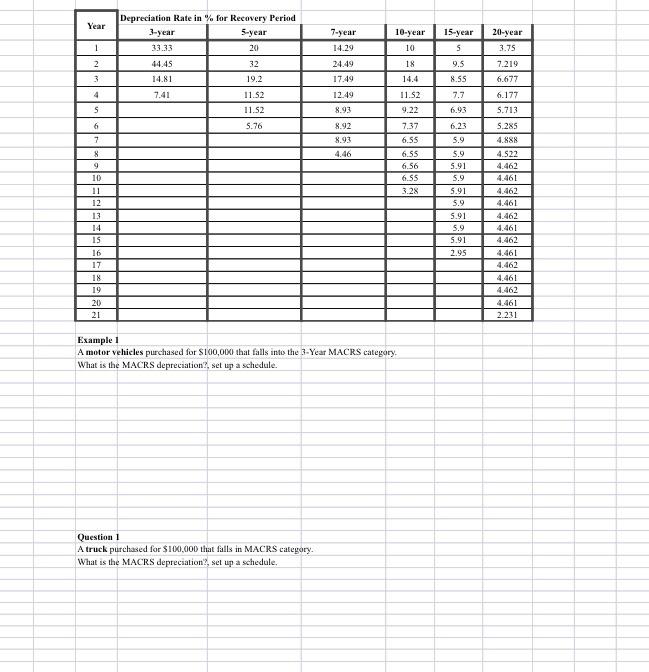

Question: how to solve these questions in step please Example 1 A motor vehieles purchased for $100,000 that falls into the 3-Year MACRS categary. What is

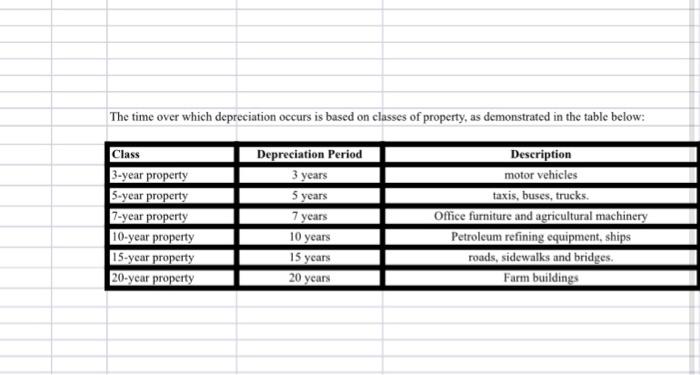

Example 1 A motor vehieles purchased for $100,000 that falls into the 3-Year MACRS categary. What is the MACRS depreciation?, set up a schedule. Question 1 A truck purchased for $100,000 that falls in MACRS category. What is the MACRS depreciation?, set up a schedule. The time over which depreciation occurs is based on classes of property, as demonstrated in the table below: \begin{tabular}{|l|c|c|} \hline Class & Depreciation Period & Description \\ \hline 3-year property & 3 years & motor vehicles \\ \hline 5-year property & 5 years & taxis, buses, trucks. \\ \hline 7-year property & 7 years & Office furniture and agricultural machinery \\ \hline 10-year property & 10 years & Petroleum refining equipment, ships \\ \hline 15-year property & 15 years & roads, sidewalks and bridges. \\ \hline 20-year property & 20 years & Farm buildings \\ \hline & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts