Question: How to solve this? Answer is A bit I cant get it Refer to the data in the table. Consider a 2-year coupon bond with

How to solve this? Answer is A bit I cant get it

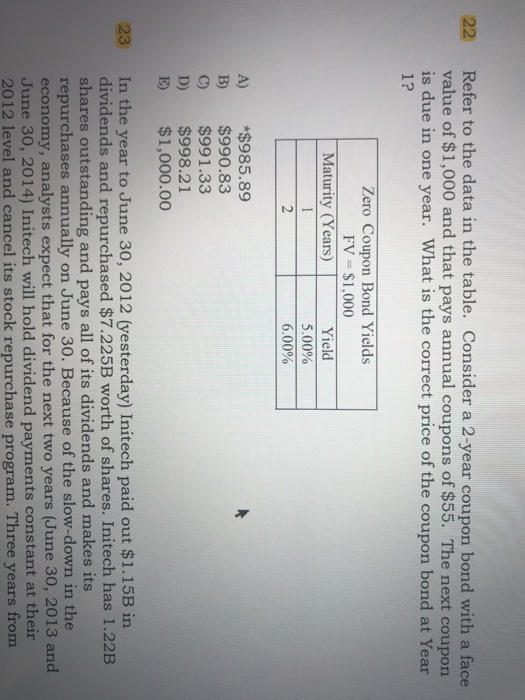

How to solve this? Answer is A bit I cant get it Refer to the data in the table. Consider a 2-year coupon bond with a face value of $1,000 and that pays annual coupons of $55. The next coupon is due in one year. What is the correct price of the coupon bond at Year 1? 22 Zero Coupon Bond Yields FV $1,000 Maturity (Years)Yield 5.00% 6.00% A) $985.89 B) $990.83 C) $991.33 D) $998.21 E) $1,000.00 In the year to June 30, 2012 (yesterday) Initech paid out $1.15B in dividends and repurchased $7.225B worth of shares. Initech has 1.22E shares outstanding and pays all of its dividends and makes its repurchases annually on June 30. Because of the slow-down in the economy, analysts expect that for the next two years (June 30, 2013 and June 30, 2014) Initech will hold dividend payments constant at their 2012 level and cancel its stock repurchase program. Three years from 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts