Question: how to solve this exercise ? Problem A bond with a nominal face value of $100,000 is redeemable by two payments, one in 5 years

how to solve this exercise ?

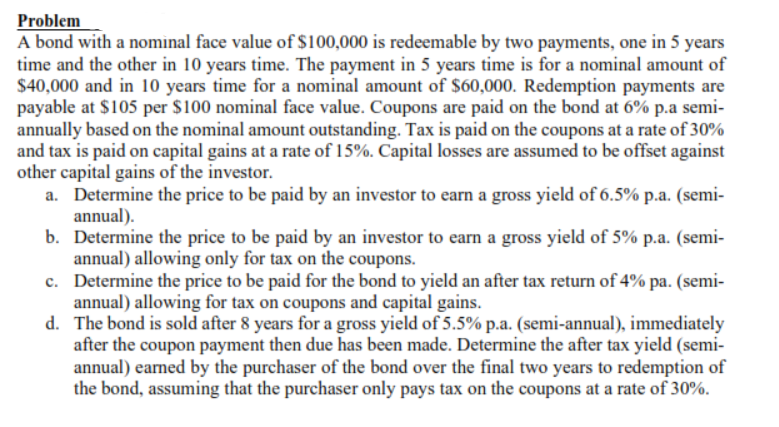

Problem A bond with a nominal face value of $100,000 is redeemable by two payments, one in 5 years time and the other in 10 years time. The payment in 5 years time is for a nominal amount of $40,000 and in 10 years time for a nominal amount of $60,000. Redemption payments are payable at $105 per $100 nominal face value. Coupons are paid on the bond at 6% p.a semi- annually based on the nominal amount outstanding. Tax is paid on the coupons at a rate of 30% and tax is paid on capital gains at a rate of 15%. Capital losses are assumed to be offset against other capital gains of the investor. a. Determine the price to be paid by an investor to earn a gross yield of 6.5% p.a. (semi- annual). b. Determine the price to be paid by an investor to earn a gross yield of 5% p.a. (semi- annual) allowing only for tax on the coupons. c. Determine the price to be paid for the bond to yield an after tax return of 4% pa. (semi- annual) allowing for tax on coupons and capital gains. d. The bond is sold after 8 years for a gross yield of 5.5% p.a. (semi-annual), immediately after the coupon payment then due has been made. Determine the after tax yield (semi- annual) earned by the purchaser of the bond over the final two years to redemption of the bond, assuming that the purchaser only pays tax on the coupons at a rate of 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts