Question: How to solve This exercise will help you think about the relation between inflation and output in the macroeconomy. Suppose that the government of Pechland

How to solve

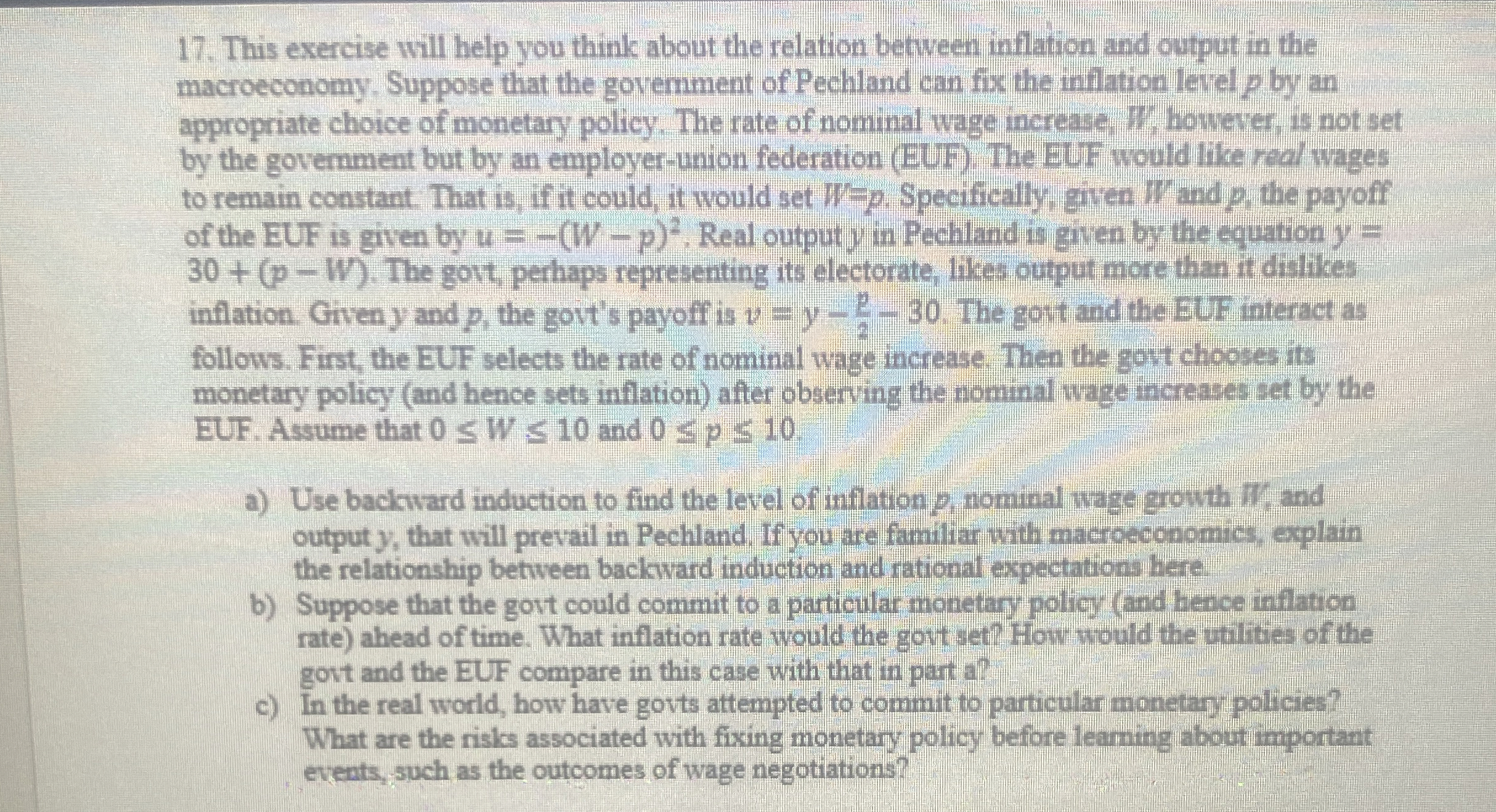

This exercise will help you think about the relation between inflation and output in the macroeconomy. Suppose that the government of Pechland can fix the inflation level by an appropriate choice of monetary policy. The rate of nominal wage increase, however, is not set by the govermment but by an employerunion federation EUF The EUF would like real wages to remain constant. That is if it could, it would set Specifically, given and the payoff of the EUF is given by Real output in Pechland is given by the equation The govt, perhaps representing its electorate, likes output more than it dislikes inflation. Given and the govt's payoff is The gort and the EUF interact as follows. First, the EUF selects the rate of nominal wage increase. Then the govt chooses its monetary policy and hence sets inflation after observing the nominal wage increases set by the EUF. Assume that and

a Use backward induction to find the level of inflation nominal wage growth and output that will prevail in Pechland. If you are familiar with macroeconomics, explain the relationship between backward induction and rational expectations here.

b Suppose that the govt could commit to a particular monetary policy and hence inflation rate ahead of time. What inflation rate would the gort set? How would the utilities of the govt and the EUF compare in this case with that in part a

c In the real world, how have govts attempted to commit to particular monetary policies? What are the risks associated with fixing monetary policy before leaming about important events, such as the outcomes of wage negotiations?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock