Question: how to solve this problem in details Chapter 8: Management of Transaction Exposure 22. Your firm is a U.K.-based exporter of British bicycles. You have

how to solve this problem in details

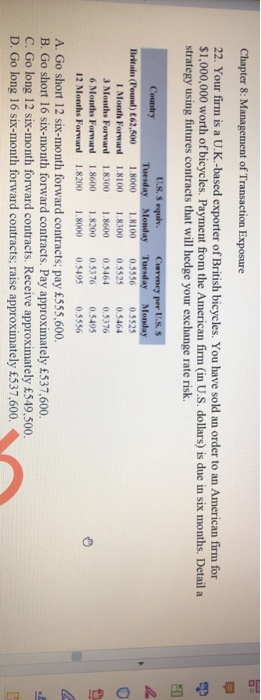

how to solve this problem in details Chapter 8: Management of Transaction Exposure 22. Your firm is a U.K.-based exporter of British bicycles. You have sold an order to an American firm for strategy using futures contracts that will hedge your exchange rate risk. 3 $1,000,000 worth of bicycles. Payment from the American firm (in U.S. dollars) is due in six months. Detail a Britain (Pound) 62,500 1.8000 1.8100 0 5556 05525 I Month Forward 1.8100 1.8300 0.5525 0.5464 3 Months Forward 1.8300 1.8600 05464 0.5376 6 Months Forward 18600 18200 05376 0.5495 12 Months Forward 1.8200 18000 0.5495 0.5556 A. Go short 12 six-month forward contracts; pay 555,600. B. Go short 16 six-month forward contracts. Pay approximately 537,600. C. Go long 12 six-month forward contracts. Receive approximately 549,500. D. Go long 16 six-month forward contracts; raise approximately 537,600. Chapter 8: Management of Transaction Exposure 22. Your firm is a U.K.-based exporter of British bicycles. You have sold an order to an American firm for strategy using futures contracts that will hedge your exchange rate risk. 3 $1,000,000 worth of bicycles. Payment from the American firm (in U.S. dollars) is due in six months. Detail a Britain (Pound) 62,500 1.8000 1.8100 0 5556 05525 I Month Forward 1.8100 1.8300 0.5525 0.5464 3 Months Forward 1.8300 1.8600 05464 0.5376 6 Months Forward 18600 18200 05376 0.5495 12 Months Forward 1.8200 18000 0.5495 0.5556 A. Go short 12 six-month forward contracts; pay 555,600. B. Go short 16 six-month forward contracts. Pay approximately 537,600. C. Go long 12 six-month forward contracts. Receive approximately 549,500. D. Go long 16 six-month forward contracts; raise approximately 537,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts