Question: how to solve this problem on excel spreadsheet? please show formula used in cells 3) Fairfield Properties owns non-residential real property that is MACRS depreciated

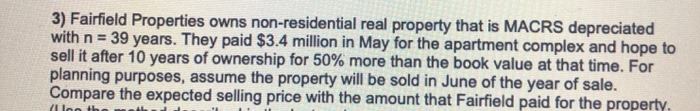

3) Fairfield Properties owns non-residential real property that is MACRS depreciated with n= 39 years. They paid $3.4 million in May for the apartment complex and hope to sell it after 10 years of ownership for 50% more than the book value at that time. For planning purposes, assume the property will be sold in June of the year of sale. Compare the expected selling price with the amount that Fairfield paid for the property. llon th 3) Fairfield Properties owns non-residential real property that is MACRS depreciated with n= 39 years. They paid $3.4 million in May for the apartment complex and hope to sell it after 10 years of ownership for 50% more than the book value at that time. For planning purposes, assume the property will be sold in June of the year of sale. Compare the expected selling price with the amount that Fairfield paid for the property. llon th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts