Question: how to solve this question, i want it be solved in written not using excel or financial calculator, thank you ASP company is considering the

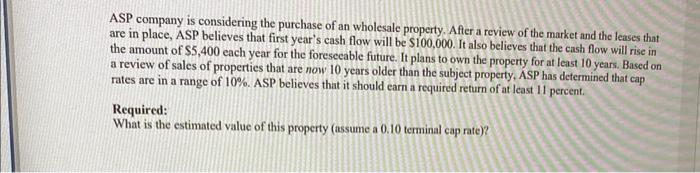

ASP company is considering the purchase of an wholesale property. After a review of the market and the leases that are in place, ASP believes that first year's cash flow will be S100,000. It also believes that the cash flow will rise in the amount of $5,400 each year for the foresecable future. It plans to own the property for at least 10 years. Based on a review of sales of properties that are now 10 years older than the subject property. ASP has determined that cap rates are in a range of 10%. ASP believes that it should earn a required return of at least 11 percent. Required: What is the estimated value of this property (assume a 0.10 terminal cap rate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts