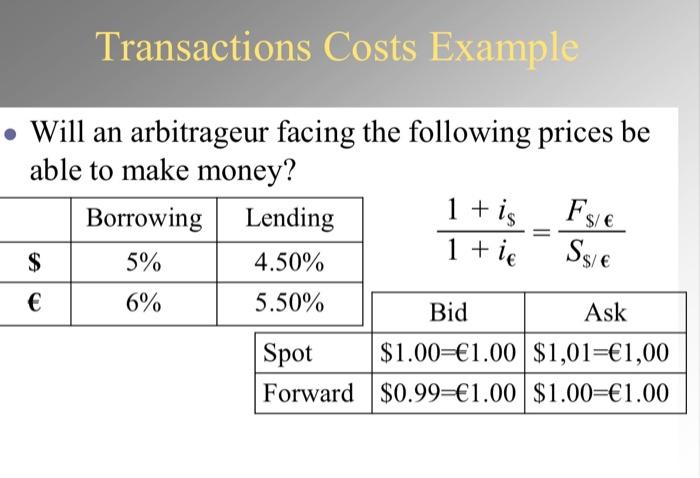

Question: how to solve this transaction costs example in backwards? (borrowing in ) Transactions Costs Example Will an arbitrageur facing the following prices be able to

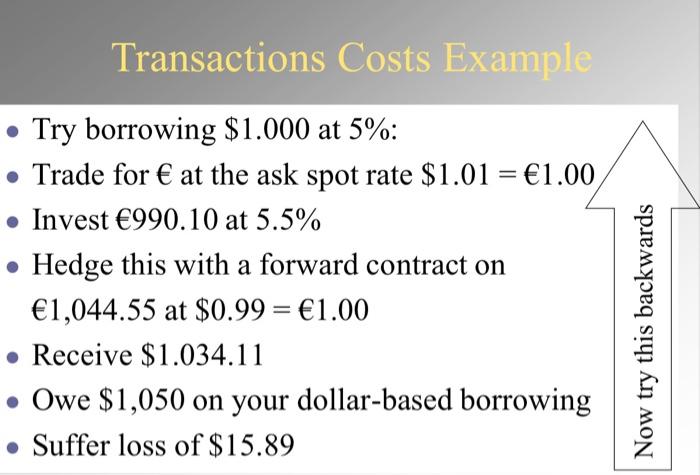

Transactions Costs Example Will an arbitrageur facing the following prices be able to make money? Borrowing Lending 1 + is Fs/e $ 5% 4.50% 1 + ie 6% 5.50% Bid Ask Spot $1.00=1.00 $1,01=1,00 Forward $0.99-1.00 $1.00=1.00 $/ Transactions Costs Example Try borrowing $1.000 at 5%: Trade for at the ask spot rate $1.01 = 1.00 Invest 990.10 at 5.5% Hedge this with a forward contract on 1,044.55 at $0.99 = 1.00 Receive $1.034.11 Owe $1,050 on your dollar-based borrowing Suffer loss of $15.89 Now try this backwards

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts