Question: how to solve this using a financial calculator? B&B has a new baby powder ready to market. If the firm goes directly to the market

how to solve this using a financial calculator?

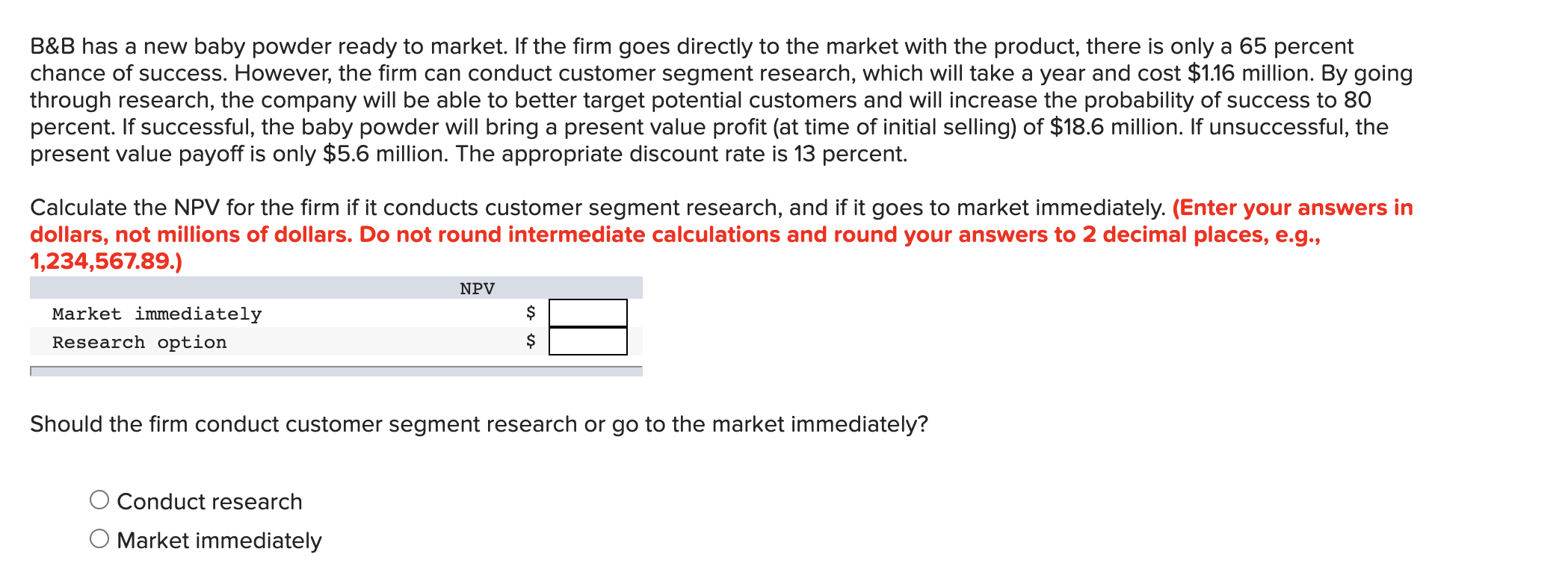

B&B has a new baby powder ready to market. If the firm goes directly to the market with the product, there is only a 65 percent chance of success. However, the firm can conduct customer segment research, which will take a year and cost $1.16 million. By going through research, the company will be able to better target potential customers and will increase the probability of success to 80 percent. If successful, the baby powder will bring a present value profit (at time of initial selling) of $18.6 million. If unsuccessful, the present value payoff is only $5.6 million. The appropriate discount rate is 13 percent. Calculate the NPV for the firm if it conducts customer segment research, and if it goes to market immediately. (Enter your answers in dollars, not millions of dollars. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 1,234,567.89.) NPV $ Market immediately Research option $ Should the firm conduct customer segment research or go to the market immediately? Conduct research Market immediately

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts