Question: How to solve White & Decker Corporation's 2 0 2 4 financial statements included the following information in the long - term debt disclosure note:

How to solve

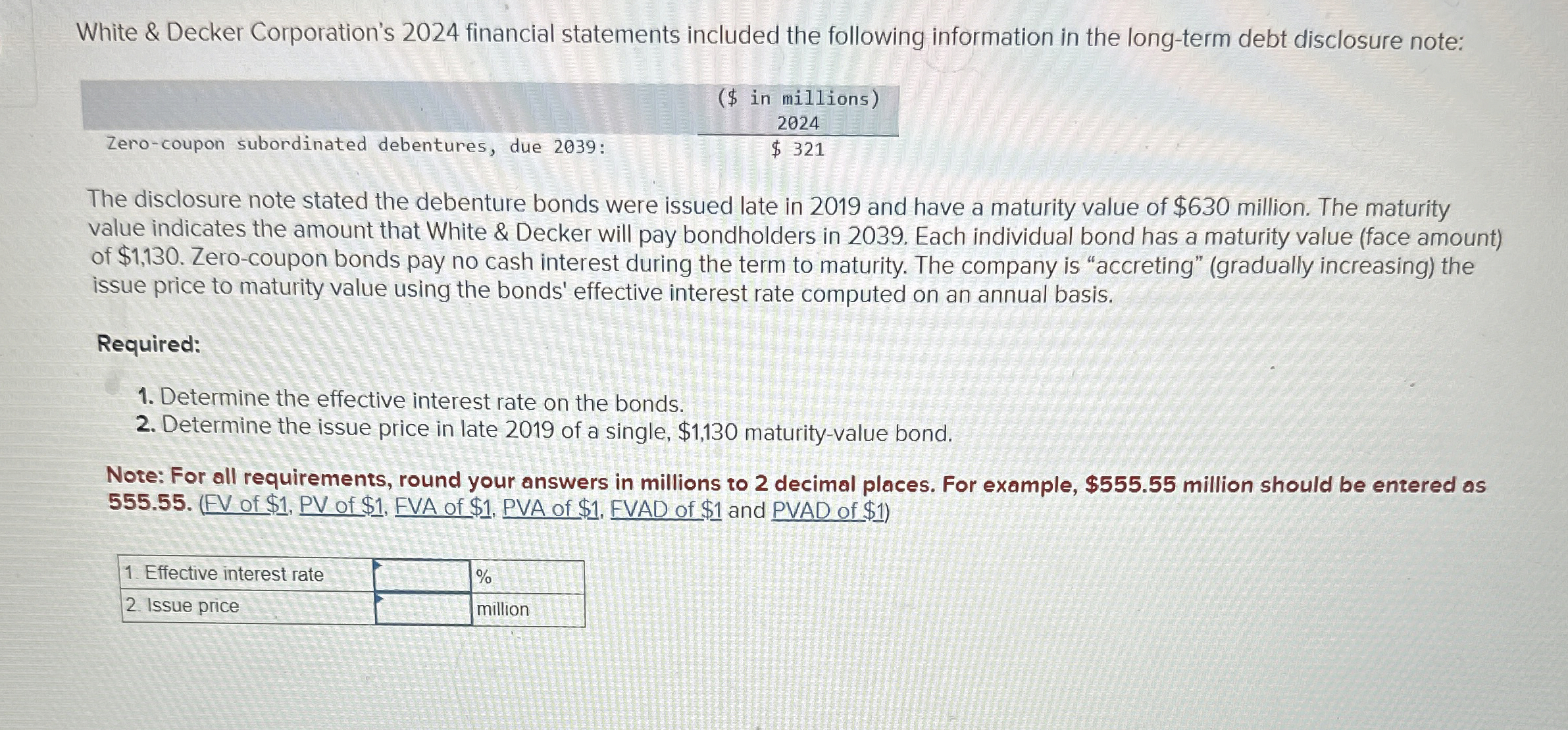

White & Decker Corporation's financial statements included the following information in the longterm debt disclosure note:

The disclosure note stated the debenture bonds were issued late in and have a maturity value of $ million. The maturity

value indicates the amount that White & Decker will pay bondholders in Each individual bond has a maturity value face amount

of $ Zerocoupon bonds pay no cash interest during the term to maturity. The company is "accreting" gradually increasing the

issue price to maturity value using the bonds' effective interest rate computed on an annual basis.

Required:

Determine the effective interest rate on the bonds.

Determine the issue price in late of a single, $ maturityvalue bond.

Note: For all requirements, round your answers in millions to decimal places. For example, $ million should be entered as

FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and PVAD of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock