Question: How to solve with excel? A present asset (defender) has a current market value of $87,000 (year 0 dollars). Estimated market values at the end

How to solve with excel?

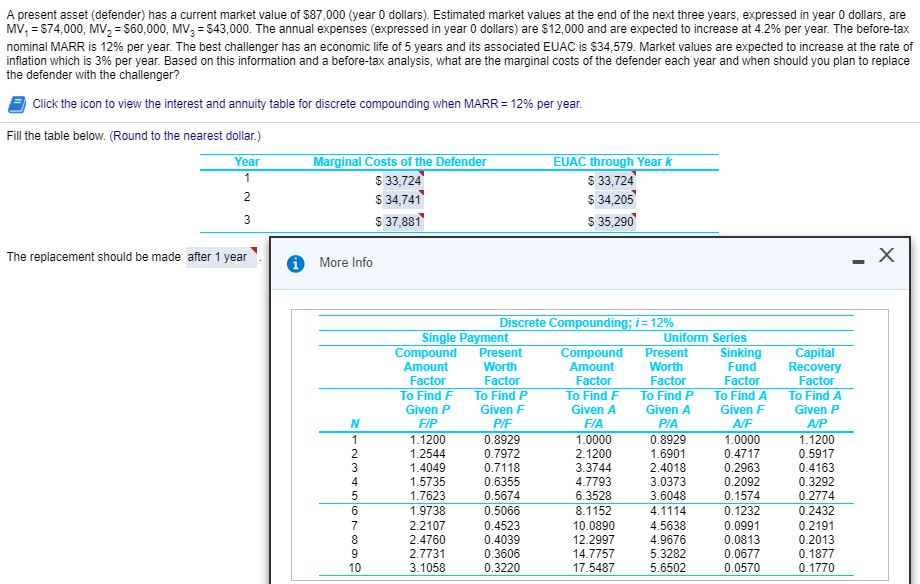

A present asset (defender) has a current market value of $87,000 (year 0 dollars). Estimated market values at the end of the next three years, expressed in year 0 dollars, are MV1 = $74.000. MV2-$60,000, MV3-$43.000. The annual expenses (expressed in year 0 dollars) are $12,000 and are expected to increase at 4.2% per year. The before-tax nominal MARR is 12% per year. The best challenger has an economic life of 5 years and its associated EUAC is $34,579. Market values are expected to increase at the rate of inflation which is 3% per year. Based on this information and a before-tax analysis, what are the marginal costs of the defender each year and when should you plan to replace the defender with the challenger? 0 Click the icon to view the interest and annuity table for discrete compounding when MARR-12% per year. Fill the table below. (Round to the nearest dollar.) Marginal Costs of the Defender EUAC through Year k S 33,724 $ 37,881 $ 35,290 The replacement should be made after 1 year Discrete Com Uniform Series Compound Present Compound PresentSinking Amount Recovery 0 To FindP Given A To Find A Given F To Find A Given P Given A 0.8929 0.8929 6 0.4717 1 0.4163 1.4049 1.5735 1.7623 0.6355 0.5674 3.0373 0.1232 10.0890 2 3 0.0813 5.3282 6 17.5487 A present asset (defender) has a current market value of $87,000 (year 0 dollars). Estimated market values at the end of the next three years, expressed in year 0 dollars, are MV1 = $74.000. MV2-$60,000, MV3-$43.000. The annual expenses (expressed in year 0 dollars) are $12,000 and are expected to increase at 4.2% per year. The before-tax nominal MARR is 12% per year. The best challenger has an economic life of 5 years and its associated EUAC is $34,579. Market values are expected to increase at the rate of inflation which is 3% per year. Based on this information and a before-tax analysis, what are the marginal costs of the defender each year and when should you plan to replace the defender with the challenger? 0 Click the icon to view the interest and annuity table for discrete compounding when MARR-12% per year. Fill the table below. (Round to the nearest dollar.) Marginal Costs of the Defender EUAC through Year k S 33,724 $ 37,881 $ 35,290 The replacement should be made after 1 year Discrete Com Uniform Series Compound Present Compound PresentSinking Amount Recovery 0 To FindP Given A To Find A Given F To Find A Given P Given A 0.8929 0.8929 6 0.4717 1 0.4163 1.4049 1.5735 1.7623 0.6355 0.5674 3.0373 0.1232 10.0890 2 3 0.0813 5.3282 6 17.5487

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts