Question: How was the forward premium calculated in this problem? Those answers are from after submission, so they are correct. Could you please should me your

How was the forward premium calculated in this problem? Those answers are from after submission, so they are correct. Could you please should me your work? I am not understanding which number is used as the spot rate and the forward rate. The question before this one we calculated the mid-rate, just in case that's relevant.

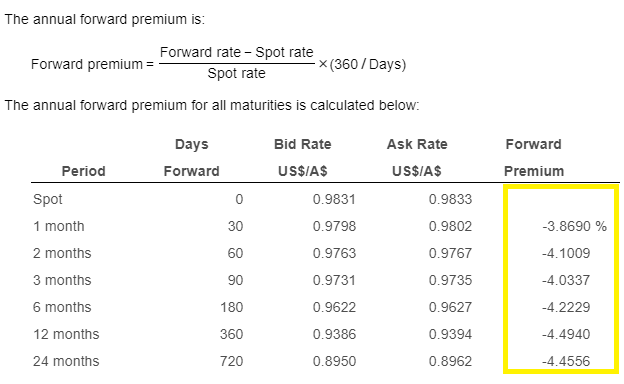

The annual forward premium is: Forward premium =- Forward rate - Spot rate Ex(360/Days) Spot rate The annual forward premium for all maturities is calculated below: Bid Rate Forward Days Forward Ask Rate US$/A$ Period US$/A$ Premium Spot 0.9831 1 month -3.8690 % 0.9798 0.9763 2 months -4.1009 3 months 0.9833 0.9802 0.9767 0.9735 0.9627 0.9394 0.8962 -4.0337 6 months 0.9731 0.9622 0.9386 0.8950 -4.2229 -4.4940 12 months 24 months -4.4556 The annual forward premium is: Forward premium =- Forward rate - Spot rate Ex(360/Days) Spot rate The annual forward premium for all maturities is calculated below: Bid Rate Forward Days Forward Ask Rate US$/A$ Period US$/A$ Premium Spot 0.9831 1 month -3.8690 % 0.9798 0.9763 2 months -4.1009 3 months 0.9833 0.9802 0.9767 0.9735 0.9627 0.9394 0.8962 -4.0337 6 months 0.9731 0.9622 0.9386 0.8950 -4.2229 -4.4940 12 months 24 months -4.4556

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts