Question: How was the pv factor that's in the table calculated? A fund manager has just purchased a new issue of one and one-half (121) year

How was the pv factor that's in the table calculated?

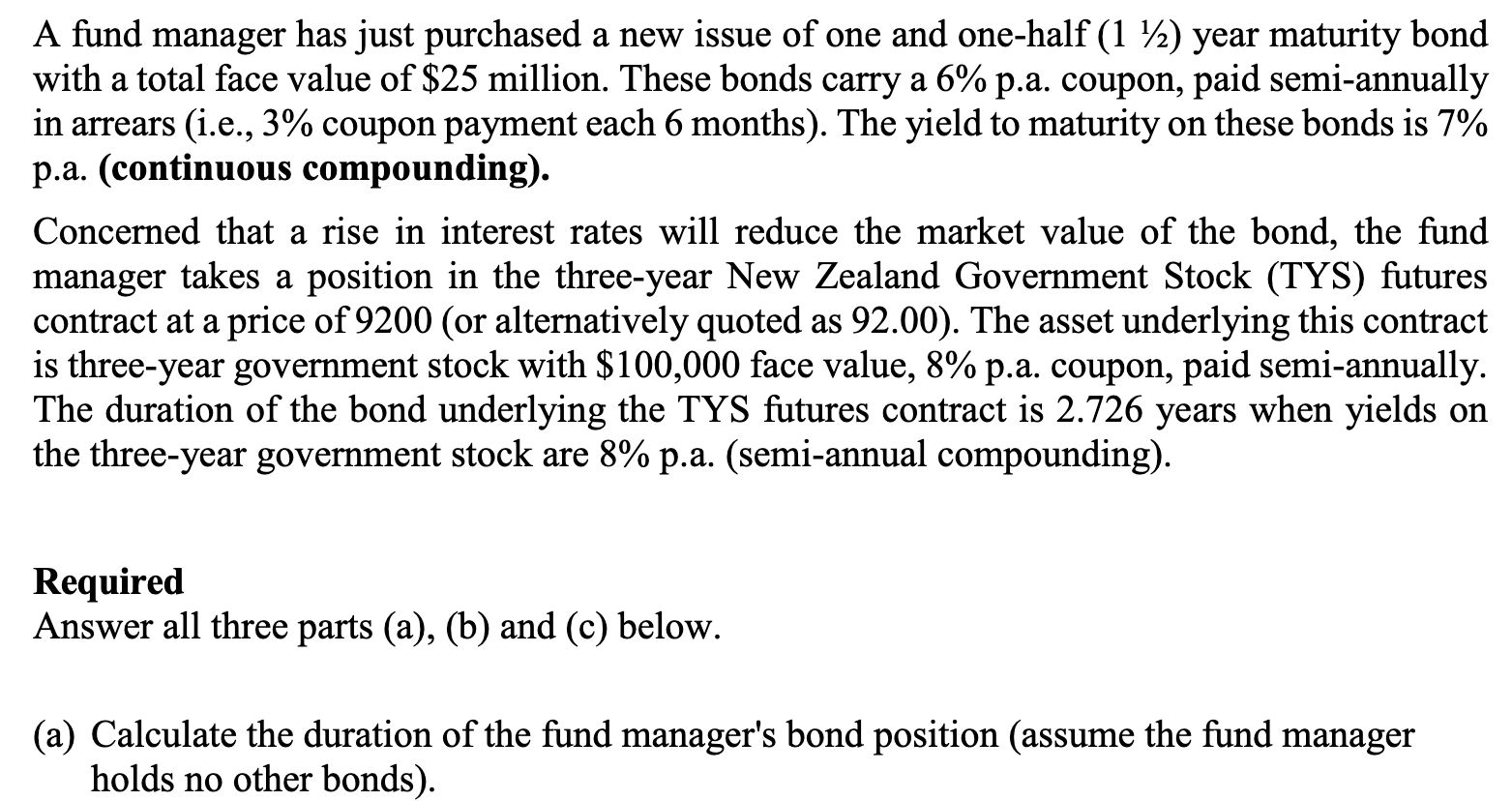

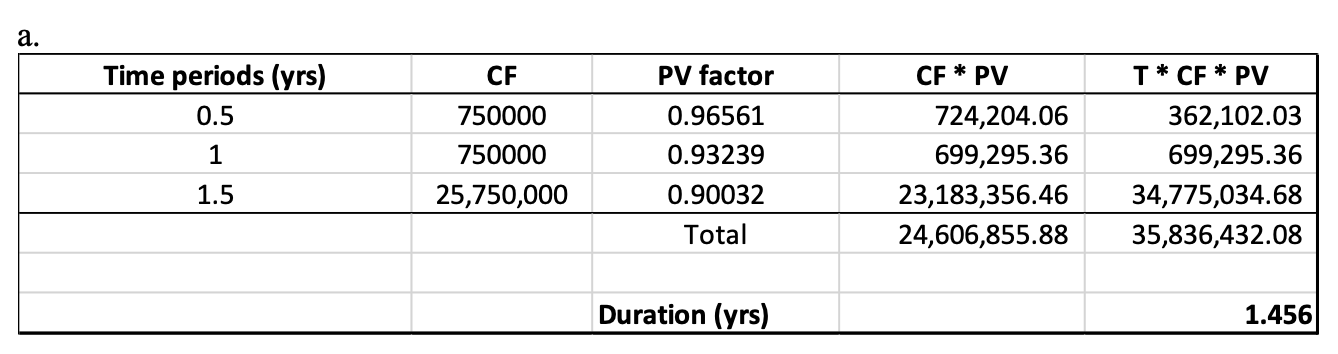

A fund manager has just purchased a new issue of one and one-half (121) year maturity bond with a total face value of $25 million. These bonds carry a 6% p.a. coupon, paid semi-annually in arrears (i.e., 3\% coupon payment each 6 months). The yield to maturity on these bonds is 7% p.a. (continuous compounding). Concerned that a rise in interest rates will reduce the market value of the bond, the fund manager takes a position in the three-year New Zealand Government Stock (TYS) futures contract at a price of 9200 (or alternatively quoted as 92.00 ). The asset underlying this contract is three-year government stock with $100,000 face value, 8% p.a. coupon, paid semi-annually. The duration of the bond underlying the TYS futures contract is 2.726 years when yields on the three-year government stock are 8% p.a. (semi-annual compounding). Required Answer all three parts (a), (b) and (c) below. (a) Calculate the duration of the fund manager's bond position (assume the fund manager holds no other bonds). a. \begin{tabular}{|c|c|c|r|r|} \hline Time periods (yrs) & CF & PV factor & CF * PV & \multicolumn{1}{|c|}{ * CF PV } \\ \hline 0.5 & 750000 & 0.96561 & 724,204.06 & 362,102.03 \\ \hline 1 & 750000 & 0.93239 & 699,295.36 & 699,295.36 \\ \hline 1.5 & 25,750,000 & 0.90032 & 23,183,356.46 & 34,775,034.68 \\ \hline & & Total & 24,606,855.88 & 35,836,432.08 \\ \hline & & & & \\ \hline & & Duration (yrs) & & 1.456 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts