Question: How we I complete these using the BA2 Plus Calculator? 1. VOLS, Inc. is doing a capital budgeting analysis for a new food truck. Revenues

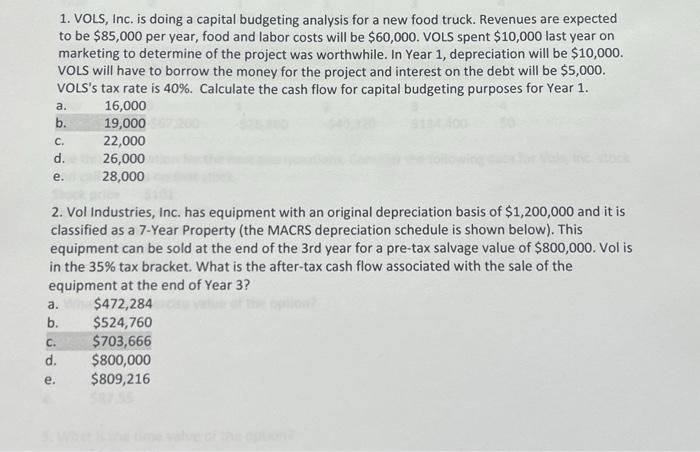

1. VOLS, Inc. is doing a capital budgeting analysis for a new food truck. Revenues are expected to be $85,000 per year, food and labor costs will be $60,000. VOLS spent $10,000 last year on marketing to determine of the project was worthwhile. In Year 1, depreciation will be $10,000. VOLS will have to borrow the money for the project and interest on the debt will be $5,000. VOLS's tax rate is 40%. Calculate the cash flow for capital budgeting purposes for Year 1. a. 16,000 b. 19,000 c. 22,000 d. 26,000 e. 28,000 2. Vol Industries, Inc. has equipment with an original depreciation basis of $1,200,000 and it is classified as a 7-Year Property (the MACRS depreciation schedule is shown below). This equipment can be sold at the end of the 3rd year for a pre-tax salvage value of $800,000. Vol is in the 35% tax bracket. What is the after-tax cash flow associated with the sale of the equipment at the end of Year 3 ? a. $472,284 b. $524,760 c. $703,666 d. $800,000 e. $809,216 1. VOLS, Inc. is doing a capital budgeting analysis for a new food truck. Revenues are expected to be $85,000 per year, food and labor costs will be $60,000. VOLS spent $10,000 last year on marketing to determine of the project was worthwhile. In Year 1, depreciation will be $10,000. VOLS will have to borrow the money for the project and interest on the debt will be $5,000. VOLS's tax rate is 40%. Calculate the cash flow for capital budgeting purposes for Year 1. a. 16,000 b. 19,000 c. 22,000 d. 26,000 e. 28,000 2. Vol Industries, Inc. has equipment with an original depreciation basis of $1,200,000 and it is classified as a 7-Year Property (the MACRS depreciation schedule is shown below). This equipment can be sold at the end of the 3rd year for a pre-tax salvage value of $800,000. Vol is in the 35% tax bracket. What is the after-tax cash flow associated with the sale of the equipment at the end of Year 3 ? a. $472,284 b. $524,760 c. $703,666 d. $800,000 e. $809,216

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts