Question: How well does the regression model work for market capitalization? I've got this set of data which i've computed from excel's regression analysis. I find

How well does the regression model work for market capitalization?

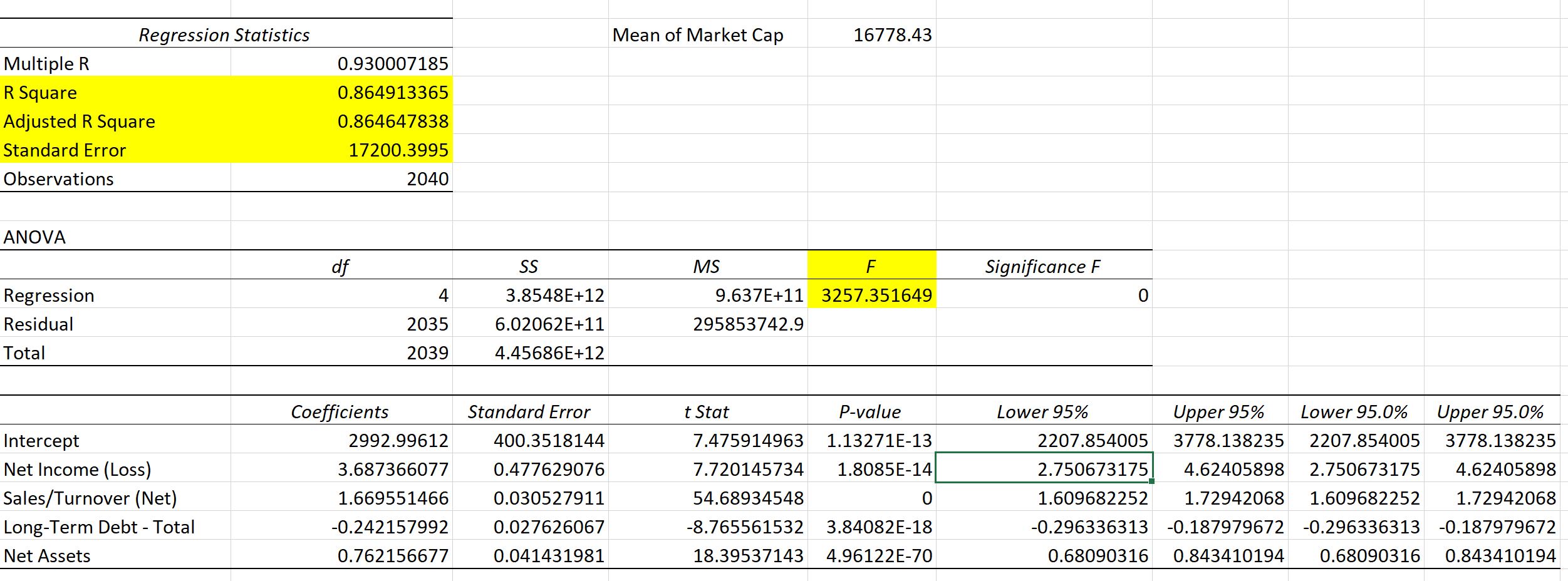

I've got this set of data which i've computed from excel's regression analysis. I find it weird that my standard error is so large! can i get some help on why is it so large and how do i get about doing this question? I've attached a pic of my data. I need help. Thanks!

Regression Statistics Mean of Market Cap 16778.43 Multiple R 0.930007185 R Square 0.864913365 Adjusted R Square 0.864647838 Standard Error 17200.3995 Observations 2040 ANOVA df 55 MS F Significance F Regression 4 3.8548E+12 9.637E+11 3257351649 0 Residual 2035 6.02062E+11 2958537429 Total 2039 4.45686E+12 Coefficients Standard Error t Stat Pvalue Lower 95% Upper 95% Lower 95.0% Upper 95.0% Intercept 2992.99612 4003518144 7475914963 1.13271E13 2207.854005 3778.138235 2207.854005 3778.138235 Net Income (Loss) 3.687366077 0.477629076 7.720145734 1.8085E-14 2.750673175- 4.62405898 2.750673175 4.62405898 Sales/Turnover (Net) 1.669551466 0030527911 5468934548 0 1.609682252 1.72942068 1.609682252 1.72942068 Long-Term Debt Tota| -0.242157992 0.027626067 8.765561S32 3.84082E18 0.296336313 -0.187979672 -0.296336313 0.187979672 Net Assets 0762156677 0041431981 1839537143 4.96122E70 0.68090316 0.843410194 0.68090316 0.843410194

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts