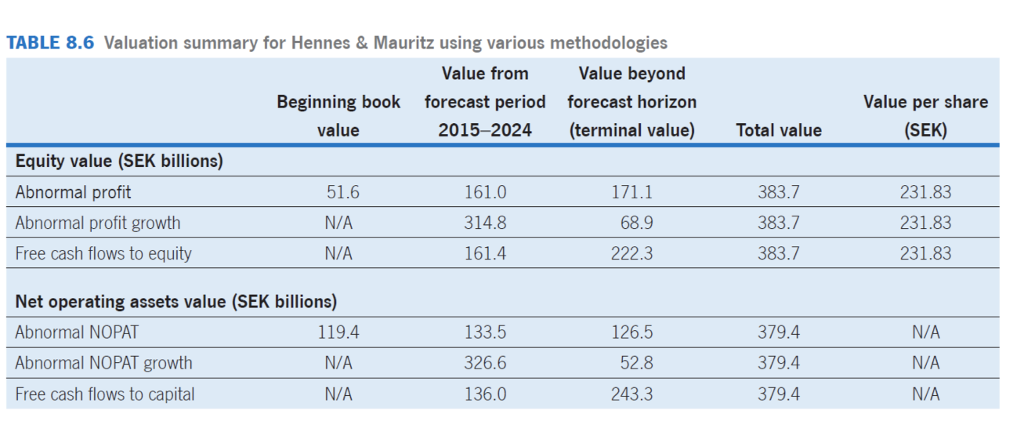

Question: How will the terminal values in Table 8.6 change if the revenue growth rate in year 2025 and beyond is 4 percent , and the

How will the terminal values in Table 8.6 change if the revenue growth rate in year 2025 and beyond is 4 percent , and the company keeps forever its abnormal returns at the same level as in fiscal 2024 (keeping all the other assumptions in the table unchanges)? If revenue growth is 3 percent in 2024 and 4 percent in 2025 , why are the equity value estimates of the free cash flow model and the abnormal profit model no longer the same?

TABLE 8.6 Valuation summary for Hennes& Mauritz using various methodologies Value from Beginning book value Value beyond forecast horizon 2015-2024 (terminal value Total value Value per share (SEK) forecast period Equity value (SEK billions) Abnormal profit Abnormal profit growth Free cash flows to equity 51.6 N/A N/A 161.0 314.8 161.4 383.7 383.7 383.7 231.83 231.83 231.83 68.9 222.3 Net operating assets value (SEK billions) Abnormal NOPAT Abnormal NOPAT growth Free cash flows to capital 119.4 N/A N/A 133.5 326.6 136.0 126.5 52.8 243.3 379.4 379.4 379.4 N/A N/A N/A TABLE 8.6 Valuation summary for Hennes& Mauritz using various methodologies Value from Beginning book value Value beyond forecast horizon 2015-2024 (terminal value Total value Value per share (SEK) forecast period Equity value (SEK billions) Abnormal profit Abnormal profit growth Free cash flows to equity 51.6 N/A N/A 161.0 314.8 161.4 383.7 383.7 383.7 231.83 231.83 231.83 68.9 222.3 Net operating assets value (SEK billions) Abnormal NOPAT Abnormal NOPAT growth Free cash flows to capital 119.4 N/A N/A 133.5 326.6 136.0 126.5 52.8 243.3 379.4 379.4 379.4 N/A N/A N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts