Question: How would a potential unexpected change in interest rate affect a bank? How should a bank attempt to manage these interest rate risks? How are

How would a potential unexpected change in interest rate affect a bank? How should a bank attempt to manage these interest rate risks?

How are credit risks measured by banks in a Basel context (i.e., how Basel approaches this), how are credit risks managed by banks (hint: credit granting decisions)? Are these implemented the same way for corporate credit and consumer credit, why/why not?

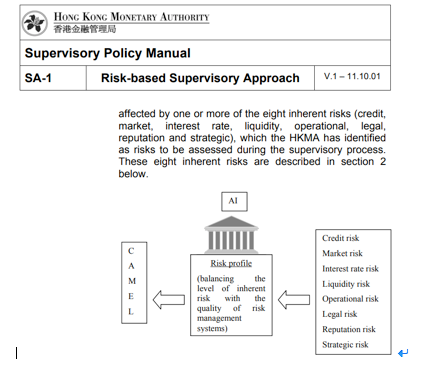

affected by one or more of the eight inherent risks (credit, market, interest rate, liquidity, operational, legal, reputation and strategic), which the HKMA has identified as risks to be assessed during the supervisory process. These eight inherent risks are described in section 2 below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts