Question: how would i answer these using excel formulas? Qustion I. Taussig Technologies Corporation (TTC) has been growing at a rate of 20% per year in

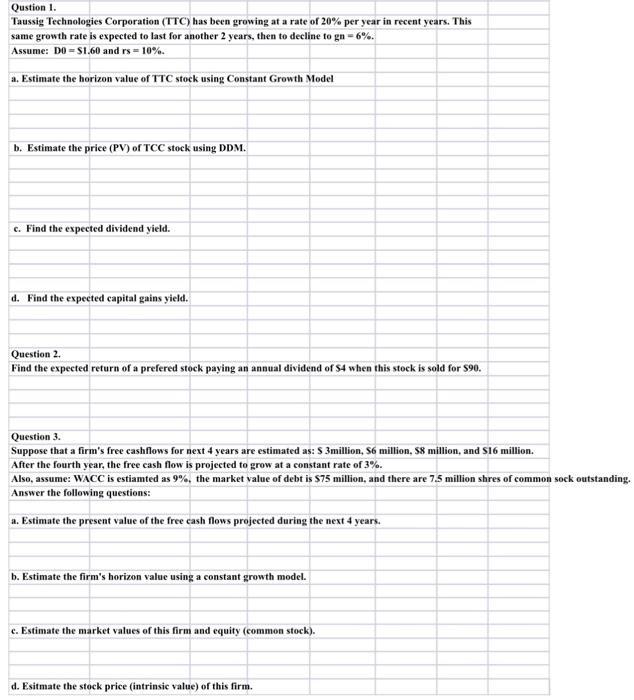

Qustion I. Taussig Technologies Corporation (TTC) has been growing at a rate of 20% per year in recent years. This same growth rate is expected to last for another 2 years, then to decline to gn=6%. Assume: D0=$1,60 and rs=10%. a. Estimate the horizon value of TTC stock using Constant Growth Model b. Estimate the price (PV) of TCC stock using DDM. c. Find the expected dividend yield. d. Find the expected capital gains yield. Question 2. Find the expected return of a prefered stock paying an annual dividend of $4 when this stock is sold for $90. Question 3. Suppose that a firm's free cashflows for next 4 years are estimated as: $3 million, $6 million, 58 million, and 516 million. After the fourth year, the free cash flow is projected to grow at a constant rate of 3%. Also, assume: WACC is estiamted as 9%, the market value of debt is 575 million, and there are 7.5 million shres of common sock outstanding. Answer the following questions: a. Estimate the present value of the free cash flows projected during the next 4 years. b. Estimate the firm's horizon value using a constant growth model. c. Estimate the market values of this firm and equity (common stock). d. Esitmate the stock price (intrinsic value) of this firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts