Question: How would i approach the last 4 problems? I have the answers but I need to be able to know how to calculate them. I

How would i approach the last 4 problems? I have the answers but I need to be able to know how to calculate them. I do not know how to put the numbers together and need to make sense of them! Basically i need to last problems wrom calculating the WACC on explained in detail. Thank you!!!. I know how to calculate the OCF and Total CF.

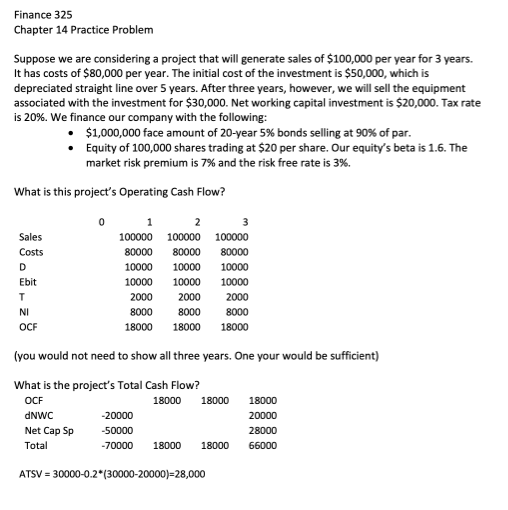

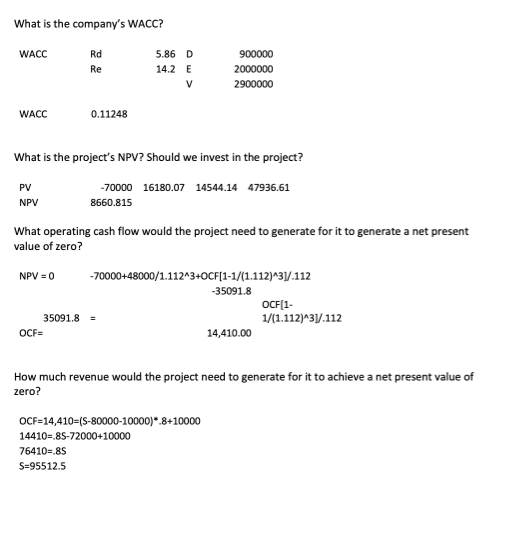

Finance 325 Chapter 14 Practice Problem Suppose we are considering a project that will generate sales of $100,000 per year for 3 years. It has costs of $80,000 per year. The initial cost of the investment is $50,000, which is depreciated straight line over 5 years. After three years, however, we will sell the equipment associated with the investment for $30,000. Net working capital investment is $20,000. Tax rate is 20%. We finance our company with the following: $1,000,000 face amount of 20-year 5% bonds selling at 90% of par. Equity of 100,000 shares trading at $20 per share. Our equity's beta is 1.6. The market risk premium is 7% and the risk free rate is 3%. What is this project's Operating Cash Flow? Sales 100000 100000 100000 80000 10000 Costs 80000 80000 10000 10000 Ebit 10000 10000 10000 2000 2000 2000 NI 8000 8000 8000 OCF 18000 18000 18000 (you would not need to show all three years. One your would be sufficient) What is the project's Total Cash Flow? 18000 OCF 18000 18000 DNWC -20000 20000 Net Cap Sp -50000 28000 Total -70000 18000 18000 66000 ATSV = 30000-0.2 (30000-20000)=28,000 What is the company's WACC? WACC Rd 5.86 D 900000 Re 14.2 E 2000000 2900000 WACC 0.11248 What is the project's NPV? Should we invest in the project? PV -70000 16180.07 14544.14 47936.61 NPV 8660.815 What operating cash flow would the project need to generate for it to generate a net present value of zero? -70000+48000/1.112^3+0CF[1-1/(1.112)^3]/.112 NPV = 0 -35091.8 OCF[1- 1/(1.112)^3]/.112 35091.8 = OCF= 14,410.00 How much revenue would the project need to generate for it to achieve a net present value of zero? OCF=14,410-(S-80000-10000)*.8+10000 14410=.85-72000+10000 76410=.85 S=95512.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts