Question: How would I be able to calcuate the answers for the yellow boxes? I am interested in knowing how to do the work, however I

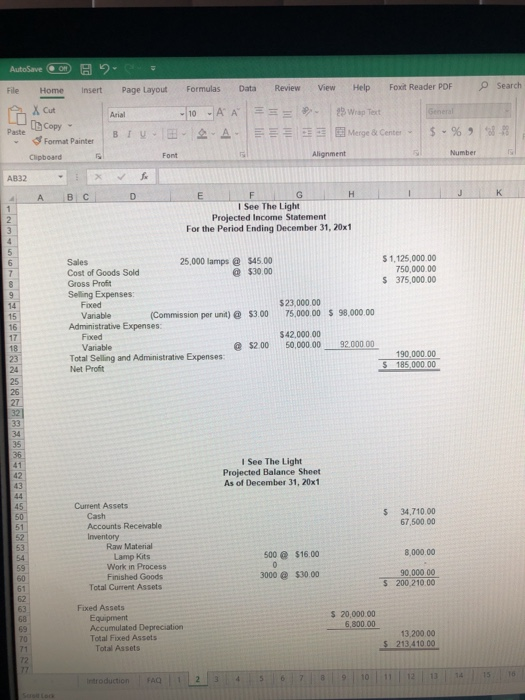

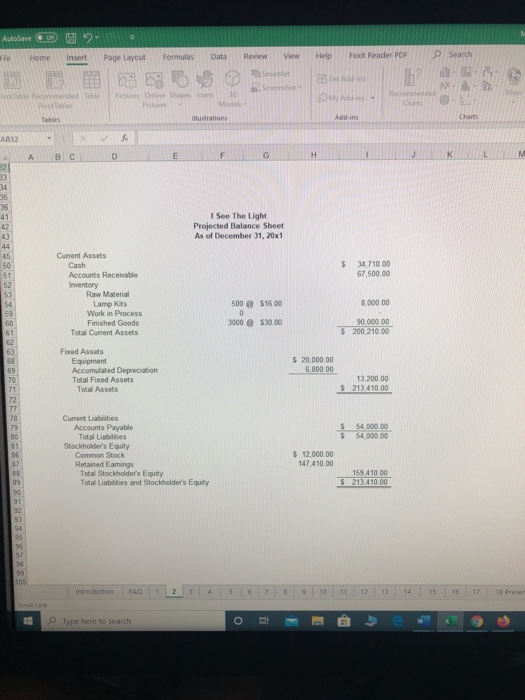

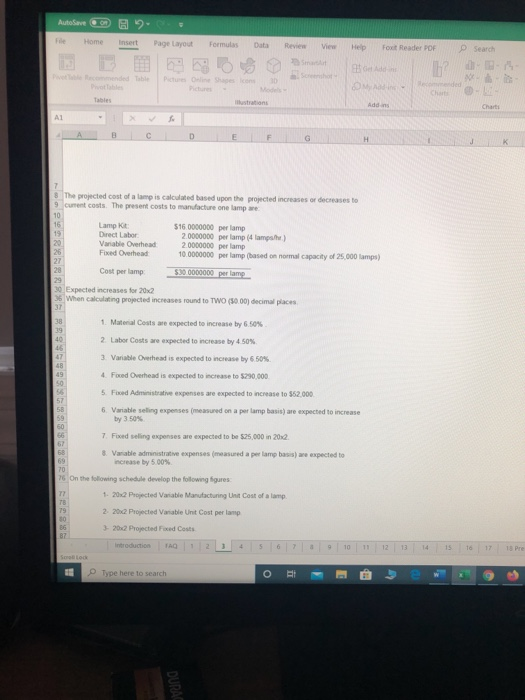

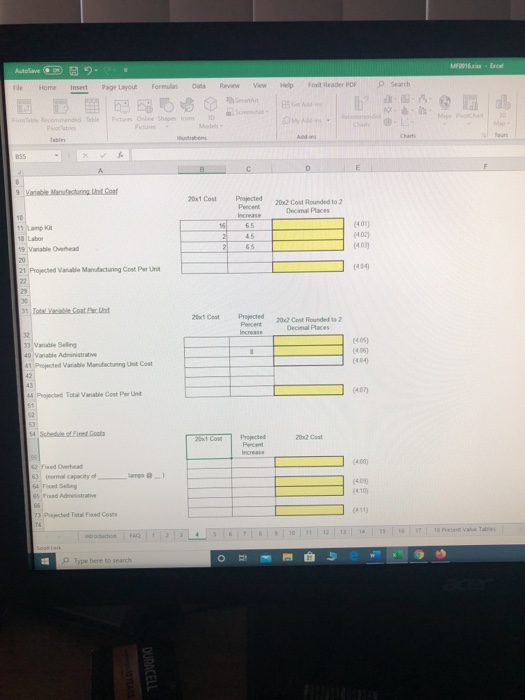

AutoSave 2 Page Layout Formulas Data Review View Help Foxit Reader PDF Search -AA File Home Insert nx cut Copy Paste Format Painter Clipboard Arial BI 10 A S -EEEE 13 Wrap Text Merge & Center - 5 - % *88-13 Font AB32 A B C D E F G 1 See The Light Projected Income Statement For the Period Ending December 31, 20x1 25,000 lamps @ 545.00 $30.00 Sales Cost of Goods Sold Gross Profit Selling Expenses: 5 1.125 000.00 750,000.00 $ 375,000.00 Fixed Variable (Commission per unit) Administrative Expenses: $3.00 $ 23,000.00 75,000.00 $ 98,000.00 Foxed @ $2.00 $42,000.00 50,000.00 92,000.00 Variable Total Selling and Administrative Expenses Net Profit $ 190,000.00 185,000.00 I See The Light Projected Balance Sheet As of December 31, 20x1 5 34.710.00 67 500 00 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets 500 @ $16.00 8,000.00 3000 @ $30.00 90,000.00 200 210.00 $ $ 20,000.00 6,800.00 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets 13,200.00 213410.00 $ Introduction FAQ 1 2 3 4 5 6 7 8 AutoSave Om Insert Data Review View Help Foxit Reader PDF Search Page Layout Formulas BO pictures Online Shapes Smart Worrible Rocommended Table Icons Illustrations AB32 A B C D E I See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67 500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets 500 $16.00 8.000.00 3000 @ $30.00 90.00000 $ 200,210.00 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Asses $20 000 00 6 800 00 13.200.00 213.410.00 $ $ $ 54.00000 54,000.00 Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Eamings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $ 12,000.00 147.410.00 159 410 00 213.410.00 5 FAQ 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Pres I Type here to search AutoSave on File Home insert Page Layout Formulas Data Review Help Table 8 The projected cost of a lamp is calculated based upon the projected increases or decreases to 9 current costs. The present costs to manufacture one lampe Lampki Direct Labor Variable Overhead Fixed Overhead $16 0000000 per lamp 20000000 per lamp (4 lamph) 2.0000000 per lamp 10.0000000 per lamp (based on normal capacity of 25.000 lamps) Cost per lamp S3010000000 per me 30. Expected increases for 20x2 36 When calculating projected increases round to TWO (50.00) decimal places 1. Material Costs are expected to increase by 6.50% 2 Labor Costs are expected to increase by 4 50% 3 Variable Overhead is expected to increase by 6.50% 4 Foxed Overhead is expected to increase to $290.000 5. Feed Administrative expenses are expected to increase to $52.000 6. Variable selling expenses measured on a per lamp basis) are expected to increase by 3.50% 7. Fixed selling expenses are expected to be $25,000 in 2012 8. Vanable administrative expenses (measureda per lamp basis) increase by 5.00% expected to 76 On the following schedule develop the following figures 1. 2012 Projected Vanable Manufacturing Unt Cost of a lamp 2. 2012 Projected Vanable Unit Cost per lamp 3- 20x2 Projected Foxed Costs Introduction D 1 2 3 4 5 6 7 9 10 11 12 13 14 15 16 17 18 Pre DE Type here to search DURASI MEB916 - Excel AutoSave o 9. File Home Insert Page Layout Formulas Data Search Review View 9 Marble Vantung Unt Cost 20x Cost Projected Cost Rounded to 2 Decimal Places (401) 11 Lamp 18 Labor 19 Variable whead (403) 21 Projected Variable Manufacturing Cost Per Unit 31 Total Cost Per Unit 20x Cool Projected 20. Cost Rounded to 2 39 Va Seling 40 Variable A nistrative Projecte Varie Maracturing Unt Cost (405) (2005 004 07 Poted Tote Vale Cost Per Unt 20 Cost (408) am ) 2 Foed Overhead 63 normal capacity of 54 Faxed Sling 65 Fond Administrative 2409 (410) 73 Proce e d Costs O 5 7 10 11 12 13 14 15 16 17 Type here to search DURACELL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts