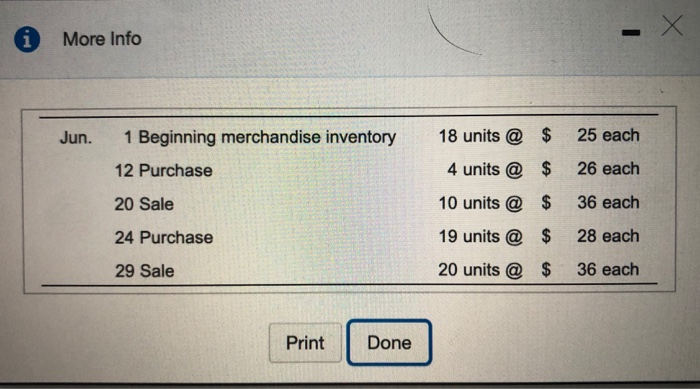

Question: How would I complete this using this format shown in pictures? i More Info Jun. 1 Beginning merchandise inventory 25 each 18 units @ $

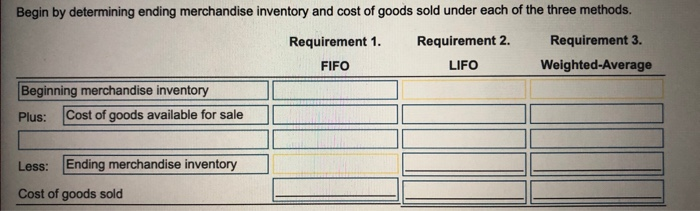

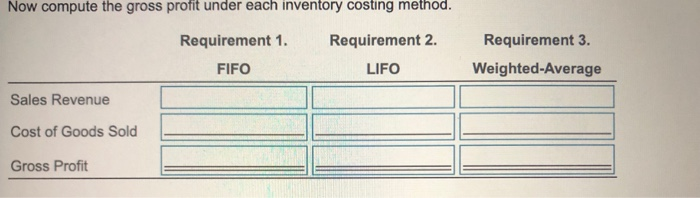

i More Info Jun. 1 Beginning merchandise inventory 25 each 18 units @ $ 4 units @ $ 12 Purchase 26 each 20 Sale 10 units @ $ 36 each 24 Purchase 19 units @ $ 28 each 29 Sale 20 units @ $ 36 each Print Done Begin by determining ending merchandise inventory and cost of goods sold under each of the three methods. Requirement 1. Requirement 2. Requirement 3. FIFO LIFO Weighted-Average Beginning merchandise inventory Plus: Cost of goods available for sale Less: Ending merchandise inventory Cost of goods sold Now compute the gross profit under each inventory costing method. Requirement 2. Requirement 1. FIFO Requirement 3. Weighted-Average LIFO Sales Revenue Cost of Goods Sold Gross Profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts