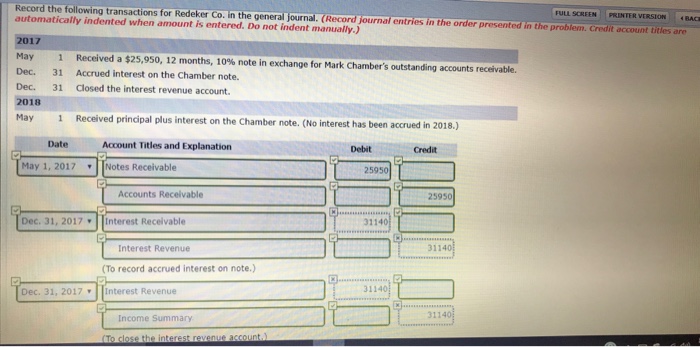

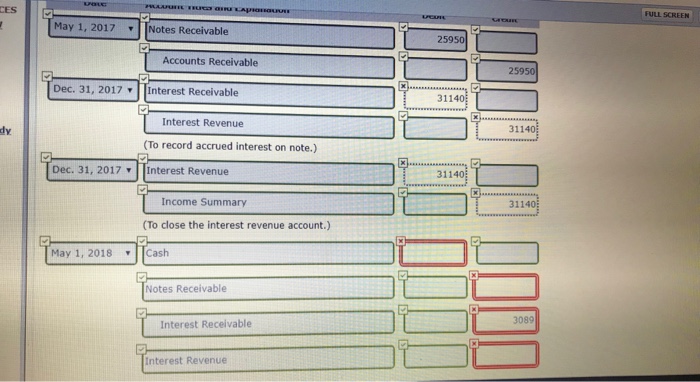

Question: How would I correct my mistakes in this problem? Record the following transactions for Redeker Co. in the general journal. (Record Sournal FULL SCREEN PRINTER

Record the following transactions for Redeker Co. in the general journal. (Record Sournal FULL SCREEN PRINTER VERSION 4BAC automatically indented when amount is entered. Do not indent manually.) 2017 May 1 Received a $25,950, 12 months, 10% note in exchange for Mark Chamber's outstanding accounts receivable. Dec. 31 Accrued interest on the Chamber note. Dec. 31 Closed the interest revenue account 2018 May 1 Received principal plus interest on the Chamber note. (No interest has been accrued in 2018.) entries in the order presented in the problem. Credit account titles are Date Account Titles and Explanation Debit Credit May 1, 2017Notes Receivable Accounts Receivable 25950 Dec. 31, 2017 Interest Recelvable 3114 Interest Revenue 31140 (To record accrued interest on note.) Dec. 31, 2017Interest Revenue 31140 Income Summany 3114

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts