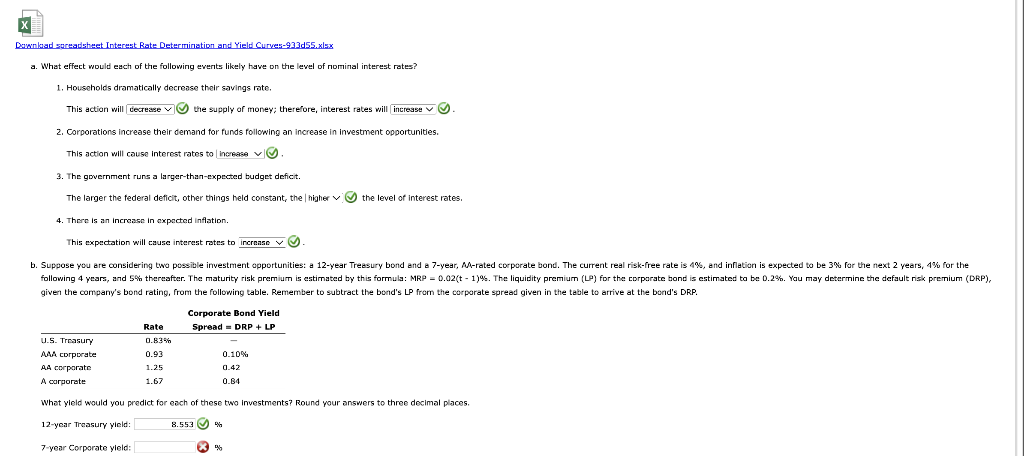

Question: How would I do the 7 year corporate yield? a. What effect would each of the following everits likely have on the level of nominal

How would I do the 7 year corporate yield?

a. What effect would each of the following everits likely have on the level of nominal interest rates? 1. Households dramatically decresse their savings rate. This action will D) the supply of money; therefore, interest rates will 9. 2. Corporations increase their demand for funds following an increase in investment opportunities. This action will cause interest rates to increase v(0. 3. The government runs a larger-than-expected budget deficit. The lamger the federal deficit, other things held constant, the | higher the level of interest rates. 4. There is an incresese in expacted inflation. This expectation will cause interest rates to b. Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7 -year, AA-rate following 4 years, and 5% thereafter. The maturity risk premium is estimated by this formula: MRP = 0.02(t)1 ) given the company's bond rating, from the following table. Remember to subtract the bond's LP from the corporate What yieid would you predict for eech of these two investments? Round your answers to three decimal places. 12-year Tressury vicid: 7-year Corporate yield: (3) %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts