Question: how would i do this? Ayres Services acquired an asset for $64 million in 2021. The asset is depreciated for financial reporting purposes over four

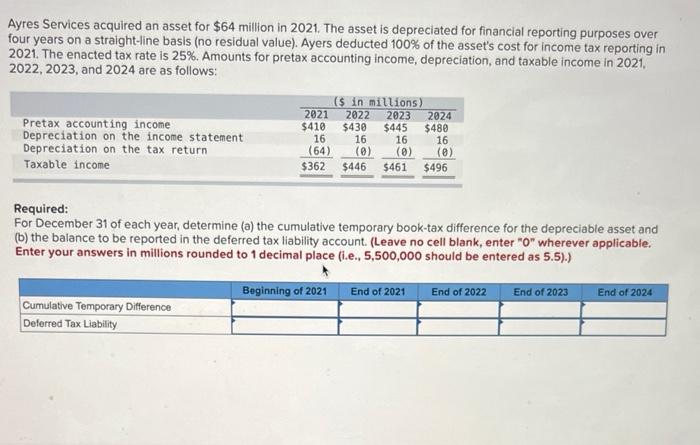

Ayres Services acquired an asset for $64 million in 2021. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). Ayers deducted 100% of the asset's cost for income tax reporting in 2021. The enacted tax rate is 25%. Amounts for pretax accounting income, depreciation, and taxable income in 2021 , 2022,2023 , and 2024 are as follows: Required: For December 31 of each year, determine (a) the cumulative temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account. (Leave no cell blank, enter "O" wherever applicable. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts