Question: How would I find the formulas for the worst and best NPVs for the sales, discount rate and variable production cost? Scenario III: Assuming the

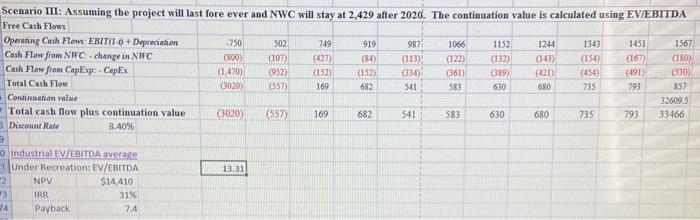

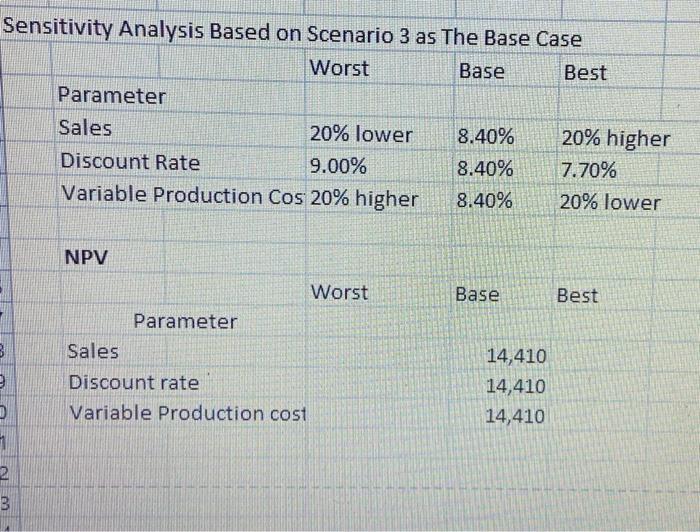

Scenario III: Assuming the project will last fore ever and NWC will stay at 2,429 after 2020. The continuation value is calculated using EV/EBITDA Free Cash Flows Operating Cash Flow EBITA + Depreciation -750 502 749 919 987 1066 1152 1244 1343 1451 1567 Cash Flow from NWC-change in NWC (800) (107) (427) (84) (113) (122) (132) (143) (154) (167 (180) Cash Flow from CapExp: - CapEx (1.470) 1952) (152) (152) (34) (361) 389) (421) (454) (491) 530 Total Cash Flow (3020) (557) 169 682 541 583 630 680 735 793 857 Continuation te 32609.5 Total cash flow plus continuation value (3020) (557) 169 682 583 630 680 735 793 33466 3 Discount Rate 8.40% 541 13.31 Industrial EV EBITDA average Under Recreations EV/EBITDA 2 NPV $14.410 13 IRR 31% Payback 7.4 Sensitivity Analysis Based on Scenario 3 as The Base Case Worst Base Best Parameter Sales 20% lower 8.40% 20% higher Discount Rate 9.00% 8.40% 7.70% Variable Production Cos 20% higher 8.40% 20% lower Base Best NPV Worst Parameter Sales Discount rate Variable Production cost B 3 14,410 14,410 14,410 1 2 3 Scenario III: Assuming the project will last fore ever and NWC will stay at 2,429 after 2020. The continuation value is calculated using EV/EBITDA Free Cash Flows Operating Cash Flow EBITA + Depreciation -750 502 749 919 987 1066 1152 1244 1343 1451 1567 Cash Flow from NWC-change in NWC (800) (107) (427) (84) (113) (122) (132) (143) (154) (167 (180) Cash Flow from CapExp: - CapEx (1.470) 1952) (152) (152) (34) (361) 389) (421) (454) (491) 530 Total Cash Flow (3020) (557) 169 682 541 583 630 680 735 793 857 Continuation te 32609.5 Total cash flow plus continuation value (3020) (557) 169 682 583 630 680 735 793 33466 3 Discount Rate 8.40% 541 13.31 Industrial EV EBITDA average Under Recreations EV/EBITDA 2 NPV $14.410 13 IRR 31% Payback 7.4 Sensitivity Analysis Based on Scenario 3 as The Base Case Worst Base Best Parameter Sales 20% lower 8.40% 20% higher Discount Rate 9.00% 8.40% 7.70% Variable Production Cos 20% higher 8.40% 20% lower Base Best NPV Worst Parameter Sales Discount rate Variable Production cost B 3 14,410 14,410 14,410 1 2 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts