Question: how would I go about doing this. I don t need the answer I just need to know how I would go about doing this

how would I go about doing this. I dont need the answer I just need to know how I would go about doing this

As the VP of Finance for a small business, you have been stretched thin just keeping the wheels on the cart. Now a new general manager GM has arrived with a lot of new questions for youthings you have not thought about since you were an undergrad. Specifically, he wants to know:

Collection Float: Interest rates have been so low for so long that no one thought much about the opportunity cost of all those payments that arrive by mail. Now that rates are higher, maybe we should at least figure out what it is costing us

Account Type: The company has banked with Wells Fargo and a regional bank for the past years. You succeeded in convincing him not to do an extensive search for new banks, but he has asked you to review the different account types offered by Wells Fargo and see which one is optimal in terms of interest, account fees and earned credit allowance.

ACHWire Transfer: Every week, money is transferred from the regional bank to the main account at Wells Faro. You have always used ACH for that transfer, but the new GM has asked you if you would ever use a wire transfer to speed up the transfer. Would it be worth it

ACH Discount: Our largest vendor has asked us to switch from paying them by check to paying by ACH. If we do that we lose the disbursement float. We should get something in exchange for that. How much of a discount should we ask for? Or even better, what is the minimum discount we should accept to make this change?

A perpetual discount actually sounds like a pain for us and for them to keep up with. What if we just asked for a onetime credit to make the transition. How much should that be

Account Balance Management: You have always targeted a minimum balance of $ for the Wells Fargo account. When the projected day balance is above $ the excess is swept into a TD Ameritrade account that earns on average. If the projected day balance goes below $ you transfer money back to the TD account to Wells Fargo. This works most of the time, but a couple of time every year, the account is over drawn. In such instances, the owner has to move money from accounts not related to this business into the Wells Fargo account, effectively providing a shortterm loan to bridge the couple of days required to get more money from the TD account to the Wells Fargo account. The GM would like to reduce these instances to no more than once per year on average. How should cash in the Wells Fargo checking account and the TD account be managed to meet that onceayear requirement?

Cashflow Forecast: Lastly, the GM would like to have a forecast of future cashflows, which could also help answer the question about the account management.

You had planned on spending the weekend in the mountains without internet access so before you left, you asked your finance analyst, Elizabeth, downloaded everything you thought you would need into one Excel file:

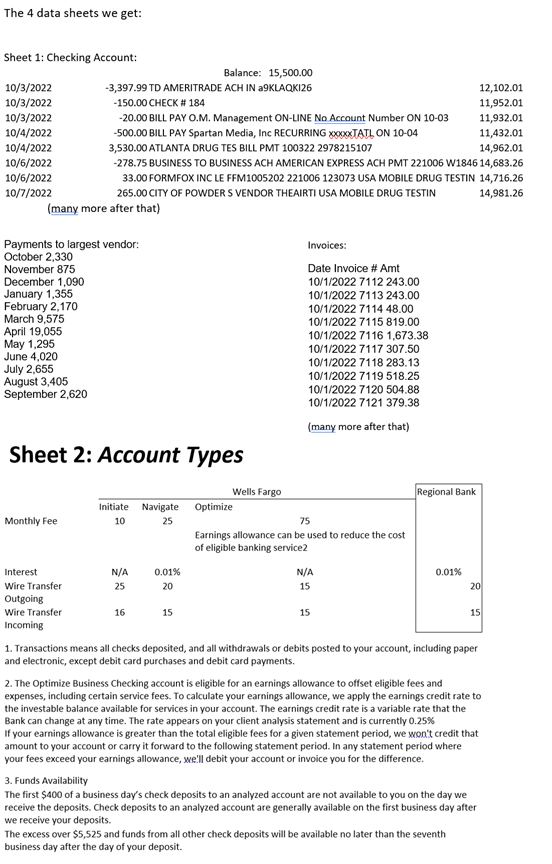

The Wells Fargo check register for the past months That will have the checks deposited either as deposits or mobile deposits.

Elizabeth summarized the account information for you. When you glanced at it before leaving Friday afternoon, you noticed two things. First, she included wire transfer costs for both banks. That will make the wire transfer question easy to answer. Second, you noticed that interest and ECA are based on collected balance, not the ledger balance that your check register shows. Its too late to call the bank to get collected balances. You will have to come up with your own estimate of collected balances based on the banks funds availability policy. That will be a challenge it may even require driving to the nearest Starbucks Saturday morning to ask Elizabeth for help on that. She is an Excel wizard. Before you call her, you need to be able to explain exactly what you need her to do

Elizabeth also pulled the payments to the vendor that wants the ACH payments. Those checks usually take days from when you mail them until they clear your checking account. That calculation should be pretty easy too.

The last thing you had Elizabeth pull for you was all the invoices generated over the past months. That must be the starting point to forecast net cash flow, right? Many expenses are fairly consistent each month and you know and can control to within a couple of days when they are paid. Variable expenses are driven by how much work we are doing for clients, which means variable expenses will move with the amount invoiced. There must be a relationship between invoices and cashflow, but trying to quantify it could be tricky.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock