Question: How would I go about solving this problem ? multiple answer. This question asks you to work through an open-market purchase of $1000 in securities

How would I go about solving this problem ?

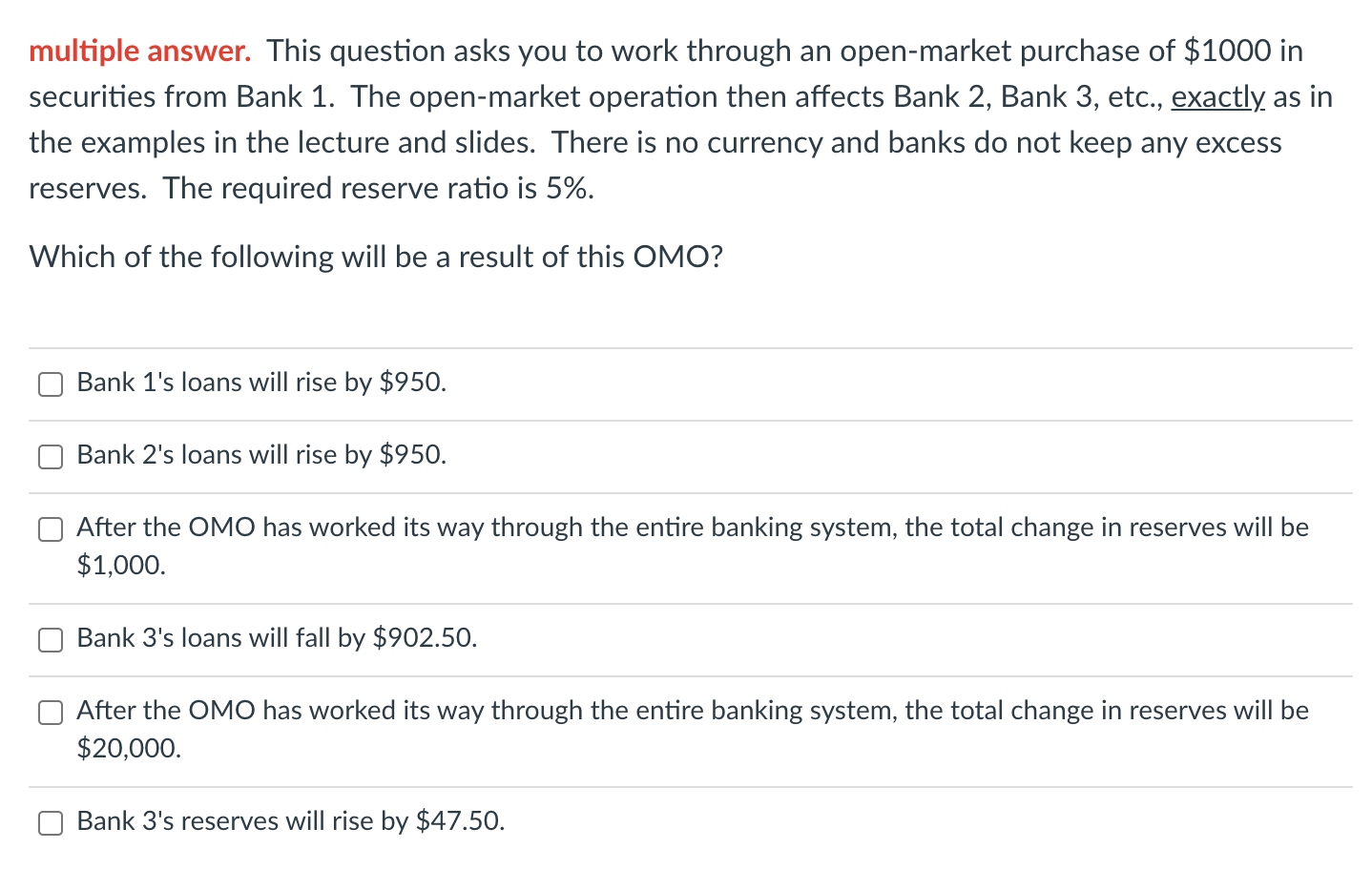

multiple answer. This question asks you to work through an open-market purchase of $1000 in securities from Bank 1. The open-market operation then affects Bank 2, Bank 3, etc., exactly as in the examples in the lecture and slides. There is no currency and banks do not keep any excess reserves. The required reserve ratio is 5%. Which of the following will be a result of this OMO? C] Bank 1's loans will rise by $950. C] Bank 2's loans will rise by $950. C] After the OMO has worked its way through the entire banking system, the total change in reserves will be $1,000. C] Bank 3's loans will fall by $902.50. C] After the OMO has worked its way through the entire banking system, the total change in reserves will be $20,000. C] Bank 3's reserves will rise by $47.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts