Question: how would I solve for g Thomas Taylor operates a kiosk in downtown Chicago, at which he sells one style of baseball hat. He buys

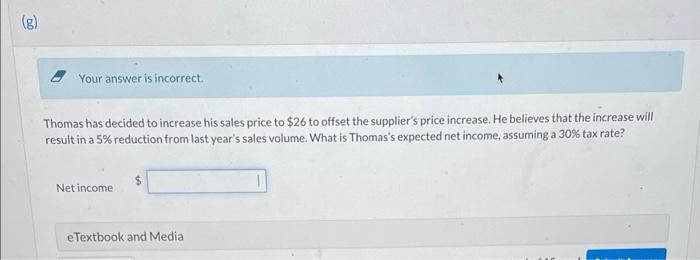

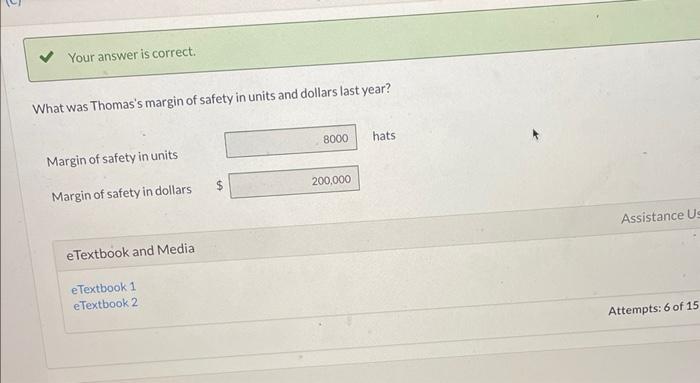

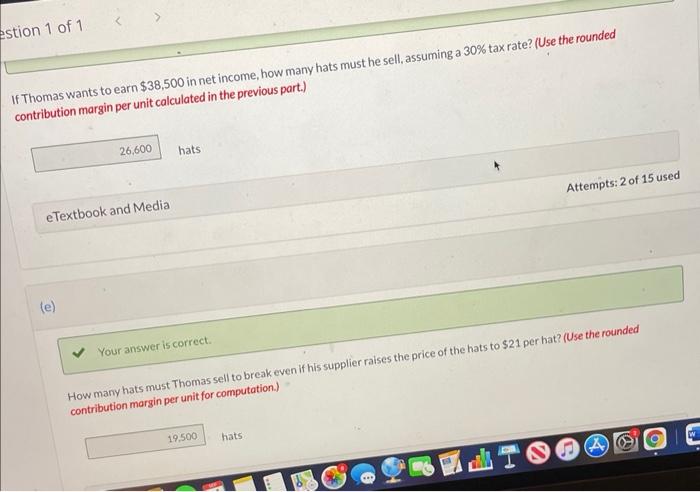

Thomas Taylor operates a kiosk in downtown Chicago, at which he sells one style of baseball hat. He buys the hats from a supplier for $20 and sells them for $25. Thomas's current breakeven point is 15,600 hats per year. Thomas has decided to increase his sales price to $26 to offset the supplier's price increase. He believes that the increase will result in a 5% reduction from last year's sales volume. What is Thomas's expected net income, assuming a 30% tax rate? Netincome Your answer is correct. What is Thomas's current level of fixed costs? (Use the rounded contribution margin per unit calculated in the previous part.) Current level of fixed costs Assistance Used eTextbook and Media eTextbook 1 Attempts: 3 of 15 use Assume that Thomas's fixed costs, variable costs, and sales price were the same last year, when he made $28,000 in net income. How many hats did Thomas sell last year, assuming a 30% income tax rate? (Use the rounded chritribution margin per unit calculated in the previous part.) hats What was Thomas's margin of safety in units and dollars last year? hats Margin of safety in units Margin of safety in dollars eTextbook and Media eTextbook 1 eTextbook 2 If Thomas wants to earn $38,500 in net income, how many hats must he sell, assuming a 30% tax rate? (Use the rounded contribution margin per unit calculated in the previous part.) hats eTextbook and Media Attempts: 2 of 15 use (e) Your answer is correct. How many hats must Thomas sell to break even if his supplier raises the price of the hats to $21 per hat? (Use the rounded contribution margin per unit for computation.) Shaw Attempt History Current Attempt in Progress Thomas Taylor operates a kiosk in downtown Chicago, at which he sells one style of baseball hat. He buys the hats from a supplier for $20 and sells them for $25. Thomas's current breakeven point is 15,600 hats per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts