Question: How would I solve problem 10? I first found the effective interest and the present value of money for both A and B. However, I

How would I solve problem 10? I first found the effective interest and the present value of money for both A and B. However, I am having trouble finding the value for X.

Any help would be greatly appreciated.

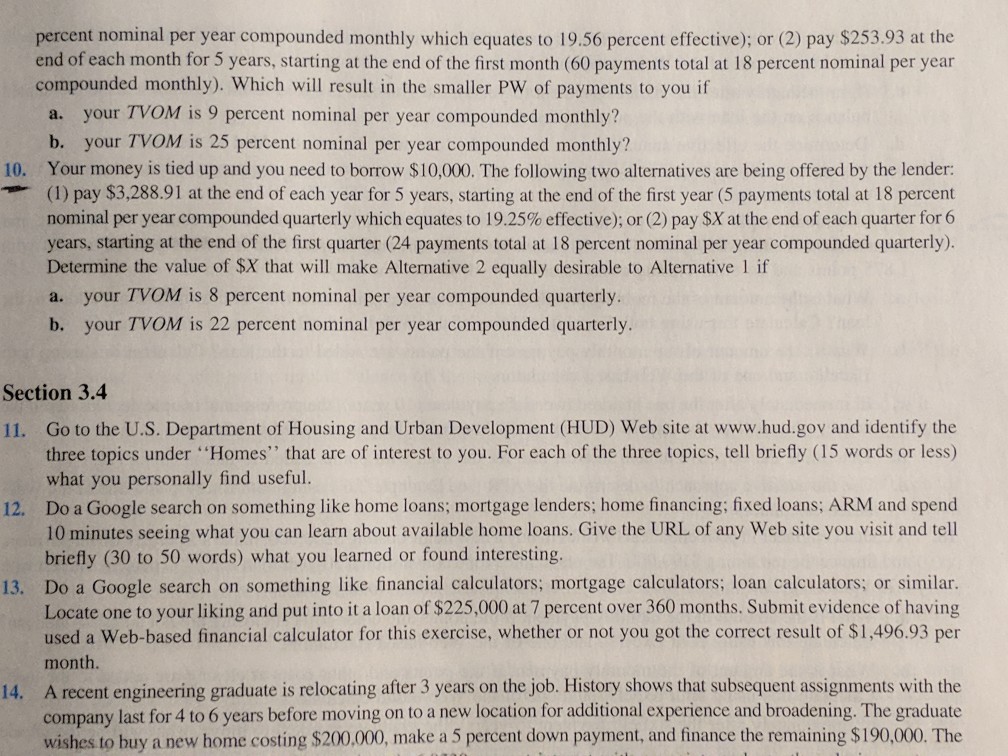

percent nominal per year compounded monthly which equates to 19.56 percent effective); or (2) pay $253.93 at the end of each month for 5 years, starting at the end of the first month (60 payments total at 18 percent nominal per year compounded monthly). Which will result in the smaller PW of payments to you if our TVOM is 9 percent nominal per year compounded monthly b. your TVOM is 25 percent nominal per year compounded monthly? 10. Your money is tied up and you need to borrow $10,000. The following two alternatives are being offered by the lender (1) pay $3,288.91 at the end of each year for 5 years, starting at the end of the first year (5 payments total at 18 percent nominal per year compounded quarterly which equates to 19.25% effective); or (2) pay $X at the end of each quarter for 6 years, starting at the end of the first quarter (24 payments total at 18 percent nominal per year compounded quarterly) Determine the value of SX that will make Alternative 2 equally desirable to Alternative 1 if a. your TVOM is 8 percent nominal per year compounded quarterly. b. your TVOM is 22 percent nominal per year compounded quarterly Section 3.4 Go to the U.S. Department of Housing and Urban Development (HUD) Web site at www.hud.gov and identify the three topics under Homes" that are of interest to you. For each of the three topics, tell briefly (15 words or less) what you personally find useful Do a Google search on something like home loans; mortgage lenders; home financing; fixed loans; ARM and spend 10 minutes seeing what you can learn about available home loans. Give the URL of any Web site you visit and tell briefly (30 to 50 words) what you learned or found interesting Do a Google search on something like financial calculators; mortgage calculators; loan calculators; Locate one to your liking and put into it a loan of $225,000 at 7 percent over 360 months. Submit evidence of having used a Web-based financial calculator for this exercise, whether or not you got the correct result of $1,496.93 per month 12. A recent engineering graduate is relocating after 3 years on the job. History shows that subsequent assignments with the company last for 4 to 6 years before moving on to a new location for additional experience and broadening. The graduate wishes to buy a new home costing $200.000, make a 5 percent down payment, and finance the remaining $190,000. The

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts