Question: How would I solve question 42 in excel? How would I solve question 42 in excel? Chapter 4 The Time Value of Money 34. You

How would I solve question 42 in excel?

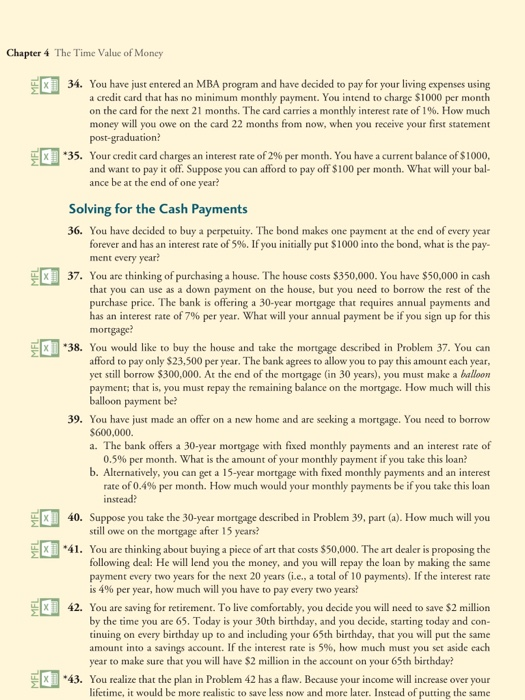

How would I solve question 42 in excel? Chapter 4 The Time Value of Money 34. You have just entered an MBA program and have decided to pay for your living expenses using a credit card that has no minimum monthly payment. You intend to charge $1000 per month on the card for the next 21 months. The card carries a monthly interest rate of 19%. How much money will you owe on the card 22 months from now, when you receive your first statement post-graduation? *35. Your credit card charges an interest rate of 2% per month. You have a current balance of $1000, and want to pay it off. Suppose you can afford to pay off $100 per month. What will your bal- ance be at the end of one year? Solving for the Cash Payments 36. You have decided to buy a perpetuity. The bond makes one payment at the end of every year forever and has an interest rate of 5 % . If you initially put $1000 into the bond, what is the pay ment every year? 37.. You are thinking of purchasing a house. The house costs $350,000. You have $50,000 in cash that you can use as a down payment on the house, but you need to borrow the rest of the purchase price. The bank is offering a 30-year mortgage that requires annual payments and has an interest rate of 7% per year. What will your annual payment be if you sign up for this mortgage? *38. You would like to buy the house and take the mortgage described in Problem 37. You can afford to pay only $23,500 per year. The bank agrees to allow you to pay this amount each year, yet still borrow $300,000. At the end of the mortgage (in 30 years), you must make a balloon payment; that is, you must repay the remaining balance on the mortgage. How much will this balloon payment be? 39. You have just made an offer on a new home and are seeking a mortgage. You need to borrow $600,000. a. The bank offers a 30-year mortgage with fixed monthly payments and an interest rate of 0.5% per month. What is the amount of your monthly payment if you take this loan? b. Alternatively, you can get a 15-year mortgage with fixed monthly payments and an interest rate of 0.4% per month. How much would your monthly payments be if you take this loan instead? 40. Suppose you take the 30-year mortgage described in Problem 39, part (a). How much will you still owe on the mortgage after 15 years? 41. You are thinking about buying a pice of art that costs $50,000. The art dealer is proposing the following deal: He will lend you the money, and you will repay the loan by making the same payment every two years for the next 20 years (i.e., a total of 10 payments). If the interest rate is 4% per year, how much will you have to pay every two years? 42. You are saving for retirement. To live comfortably, you decide you will need to save $2 million by the time you are 65. Today is your 30th birthday, and you decide, starting today and con- tinuing on every birthday up to and including your 65th birthday, that you will put the same amount into a savings account. year to make sure that you will have $2 million in the account on your 65th birthday? the interest rate is 5 %, how much must you set aside each 43. You realize that the plan in Problem 42 has a flaw. Because your income will increase over your lifetime, it would be more realistic to save less now and more later. Instead of putting the same 1Hlel Hle 14la 1Hlk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts