Question: how would i solve the highlighted portion that is not answered, with the given information using excel formulas? John Green, a recent graduate with four

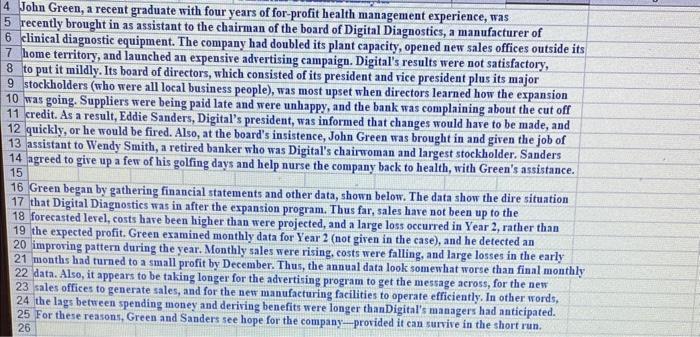

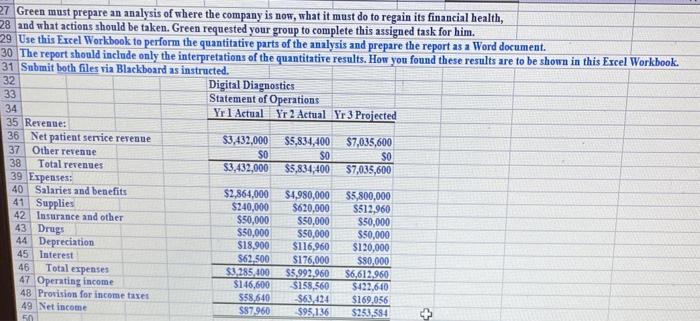

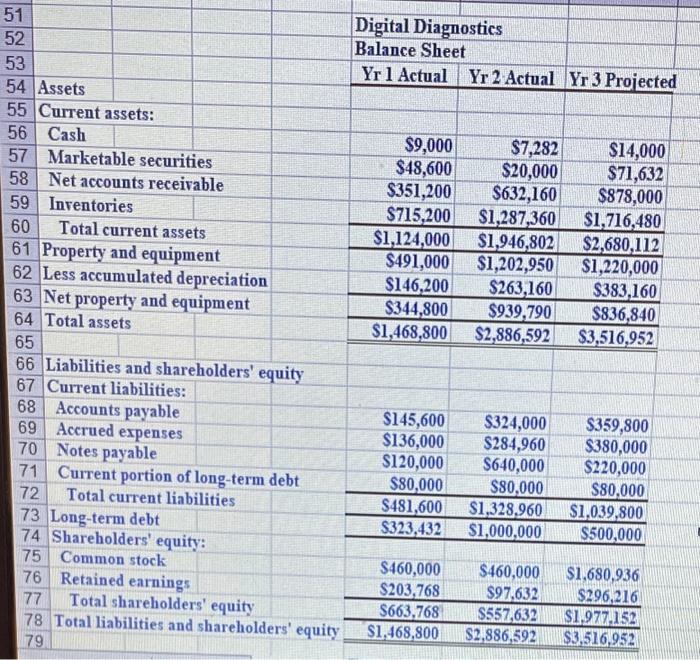

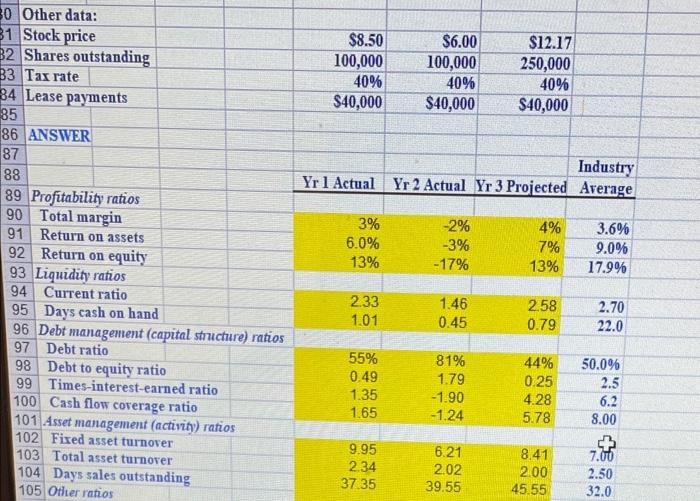

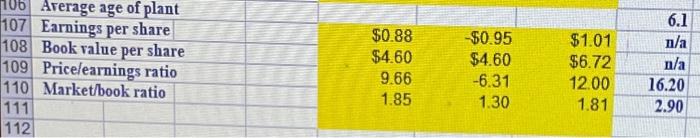

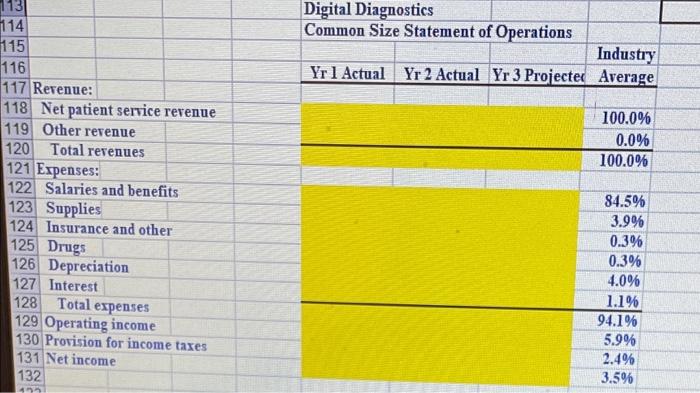

John Green, a recent graduate with four years of for-profit health management experience, was recently brought in as assistant to the chairman of the board of Digital Diagnostics, a manufacturer of clinical diagnostic equipment. The company had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Digital's results were not satisfactory, 8 to put it mildly. Its board of directors, which consisted of its president and rice president plus its major 9 stockholders (who were all local business people), was most upset when directors learned how the expansion 10 was going. Suppliers were being paid late and were unhappy, and the bank was complaining about the cut off 11 credit. As a result, Eddie Sanders, Digital's president, was informed that changes would hare to be made, and 12 quickly, or he would be fired. Also, at the board's insistence, John Green was brought in and given the job of 13 assistant to Wendy Smith, a retired banker who was Digital's chairwoman and largest stockholder. Sanders 14 agreed to give up a fer of his golfing days and help nurse the company back to health, with Green's assistance. 15 16 Green began by gathering financial statements and other data, shown below. The data show the dire situation 17 that Digital Diagnostics was in after the expansion program. Thus far, sales have not been up to the 18 forecasted level, costs hare been higher than were projected, and a large loss occurred in Year 2, rather than 19 the expected profit. Green examined monthly data for Year 2 (not given in the case), and he detected an 20 improving pattern during the year. Monthly sales were rising, costs were falling, and large losses in the early 21 months had turned to a small profit by December. Thus, the annual data look somewhat worse than final monthly 22 data. Also, it appears to be taking longer for the advertising program to get the message across, for the new 23 sales offices to generate sales, and for the nen manufacturing facilities to operate efficiently. In other words, 24 the lags between spending money and deriving benefits were longer thanDigital's managers had anticipated. 25 For these reasons, Green and Sanders see hope for the company-provided it can survive in the short run. Green must prepare an analysis of where the company is now, what it must do to regain its financial health, and what actions should be taken. Green requested your group to complete this assigned task for him. 9 Use this Errel Workbook to perform the quantitatire parts of the analysis and prepare the report as a Word document. 0 The report should include only the interpretations of the quantitatire results. How you found these results are to be shown in this Ercel Workbook. 11 Submit both files ria Blackboand as instructed. 30 Other data: 100 Arerage age of plant 107 Earnings per share 108 Book value per share 109 Pricelearnings ratio 110 Market/book ratio \begin{tabular}{|r|r|r|r|} \hline$0.88 & $0.95 & $1.01 & n/a \\ \hline$4.60 & $4.60 & $6.72 & n/a \\ \hline 9.66 & 6.31 & 12.00 & 16.20 \\ \hline 1.85 & 1.30 & 1.81 & 2.90 \\ \hline \end{tabular} Digital Diagnostics Common Size Statement of Operations Industry \begin{tabular}{|r|r|r|} Yr 1 Actual & Yr 2 Actual & Yr 3 Projecter Average \\ \hline \end{tabular} 118 Net patient service revenue 119 Other revenue 120 Total rerenues 121 Expenses: 122 Salaries and benefits 123 Supplies 124 Insurance and other 125 Drugs 126 Depreciation 127 Interest 128 Total expenses 129 Operating income 130 Prorision for income taxes 131 Net income 132 \begin{tabular}{|r|r|} \hline 100.0% \\ \hline 0.0% \\ \hline 100.0% \\ \hline & 84.5% \\ \hline 3.9% \\ \hline 0.3% \\ \hline 0.3% \\ \hline 4.0% \\ \hline 1.1% \\ \hline 94.1% \\ \hline 5.9% \\ \hline 2.4% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts