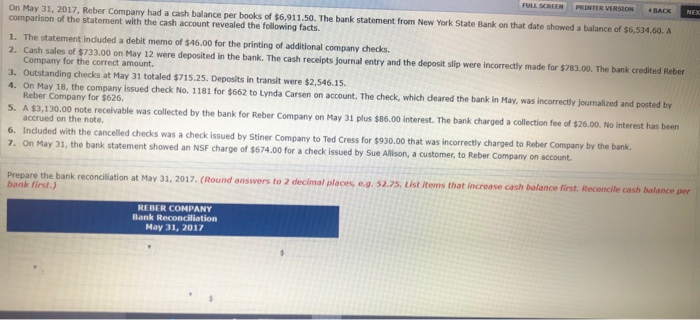

Question: How would I solve this? FULL SCREEN PRNTER VERSION-BACK Re On May 31, 2017, Reber Company had a cash balance per books of $6,911.50. The

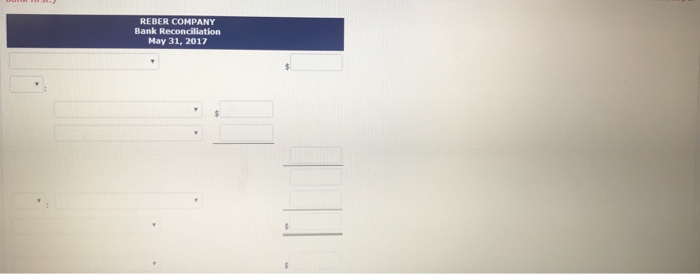

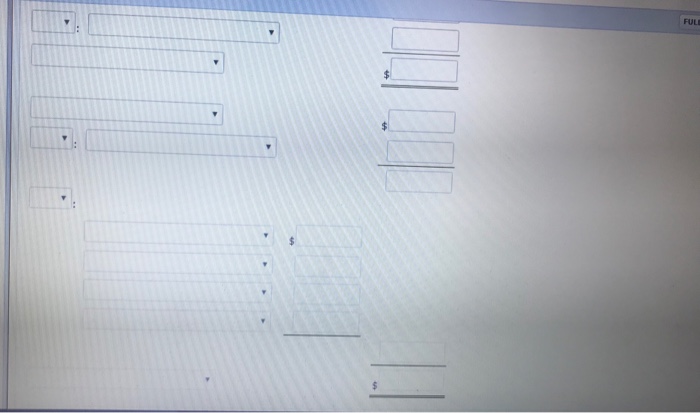

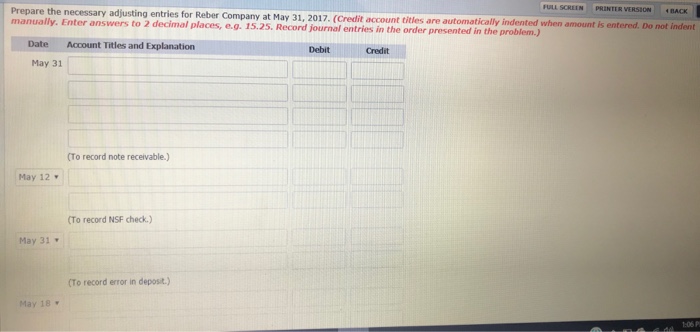

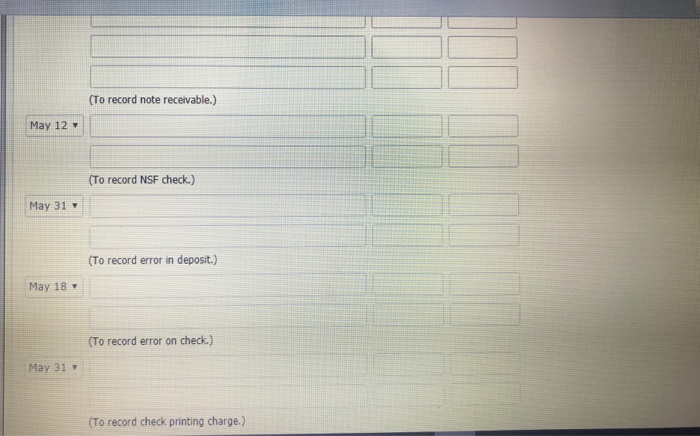

FULL SCREEN PRNTER VERSION-BACK Re On May 31, 2017, Reber Company had a cash balance per books of $6,911.50. The bank statement from New York State Bank on that date showed a balance of $6,534.60. A comparison of the statement with the cash account revealed the following facts. 1. The statement included a debit memo of $46.00 for the printing of additional company checks 2. Cash sales of $733.00 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $783.00. The bank credited Reber Company for the correct amount. 3. Outstanding checks at May 31 totaled $715.25. Deposits in transit were $2,546.15 4. On May 18, the company issued check No. 1181 for $662 to Lynda Carsen on account. The check, which deared the bank in May, was incorrectly jounalized and posted by Reber Company for $626. 5. A $3,130.00 note receivable was collected by the bank for Reber Company on May 31 plus $86.00 interest. The bank charged a collection fee of $26.00. No interest has beer accrued on the note. 6. Induded with the cancelled checks was a check issued by Stiner Company to Ted Cress for $930.00 that was incorrectly charged to Reber Company by the bank 7. On May 31, the bank statement showed an NSF charge of $674.00 for a check issued by Sue Alison, a customer, to Reber Company on account Prepare the bank reconciliation at May 31, 2017. (Round bank first.) answers to 2 decimal places, e.g. 52.75. List items that increase cash balance first. Reconcile cash balance REBER COMPANY Bank Reconciliation Hay 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts