Question: How would I solve this? The following are selected transactions of Blanco Company. Blanco prepares financial statements quarter Jan. 2 Purchased merchandise on account from

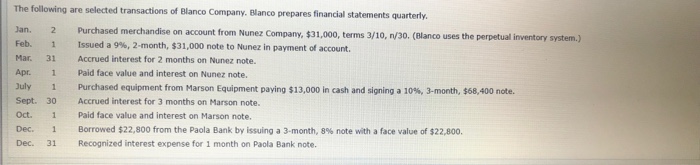

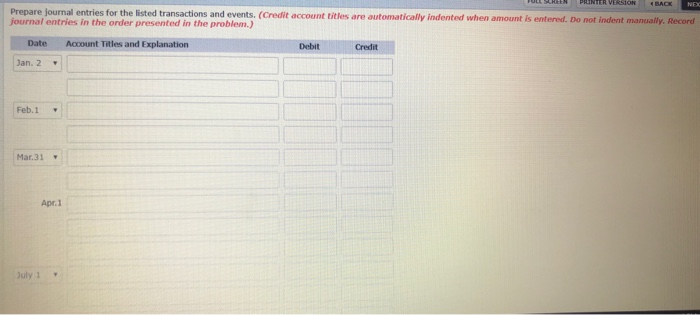

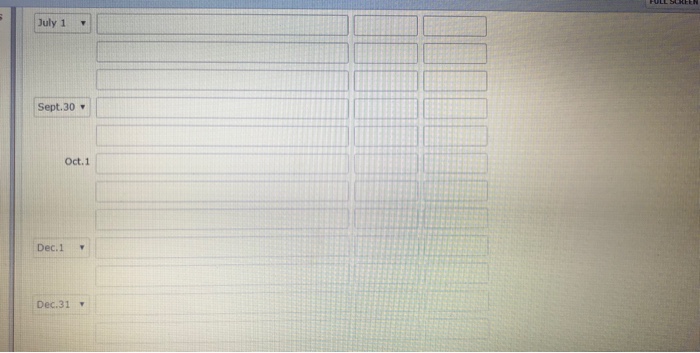

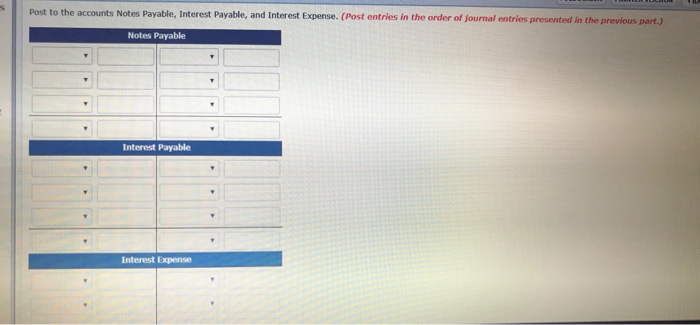

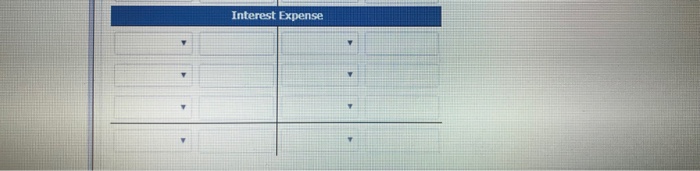

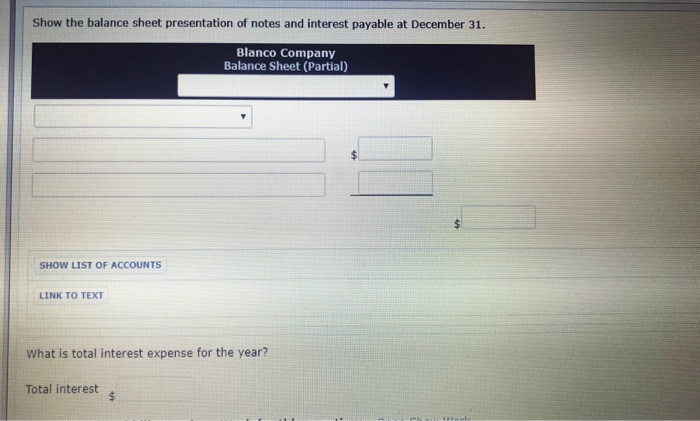

The following are selected transactions of Blanco Company. Blanco prepares financial statements quarter Jan. 2 Purchased merchandise on account from Nunez Feb. 1 Issued a 9%, 2-month, $31,000 note to Nunez in payment of account. Mar 31 Accrued interest for 2 months on Nunez note. Apr. 1 Paid face value and interest on Nunez note. Company, $31,000, terms 3/10, n/30. (Blanco uses the perpetual inventory | July Sept. Oct. Dec. Dec. 1 30 1 1 31 Purchased equipment from Marson Equipment paying $13,000 in cash and signing a 10%, 3-month. S68.400 note. Accrued interest for 3 months on Marson note. Paid face value and interest on Marson note. Borrowed $22,800 from the Paola Bank by issuing a 3-month, 8% note with a face value of $22,800. Recognized interest expense for 1 month on Paola Bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts