Question: how would i sovle these? 21) How much should an investor pay for a property that is expected to generate annual triple net operating income

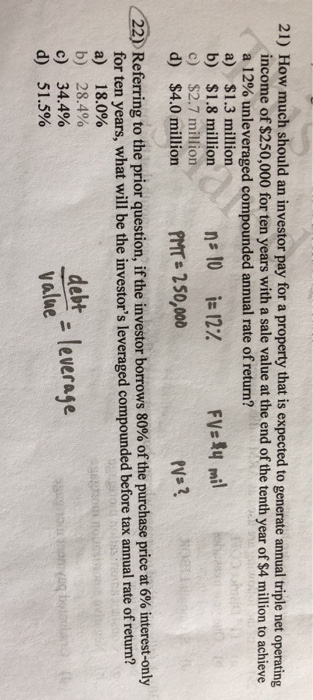

21) How much should an investor pay for a property that is expected to generate annual triple net operating income of $250,000 for ten years with a sale value at the end of the tenth year of $4 million to achieve a 12% unleveraged compounded annual rate of return? a) $1.3 million b) $1.8 million c) $2.7 million d) S4.0 million I250, FV- 4 mil Referring to the prior question, if the investor borrows 80% of the purchase price at 6% interest-only for ten years, what will be the investor's leveraged compounded before tax annual rate of return? a) 18.0% b) 28.4% c) 34.4% d) 51.5% debt pt leverage value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts