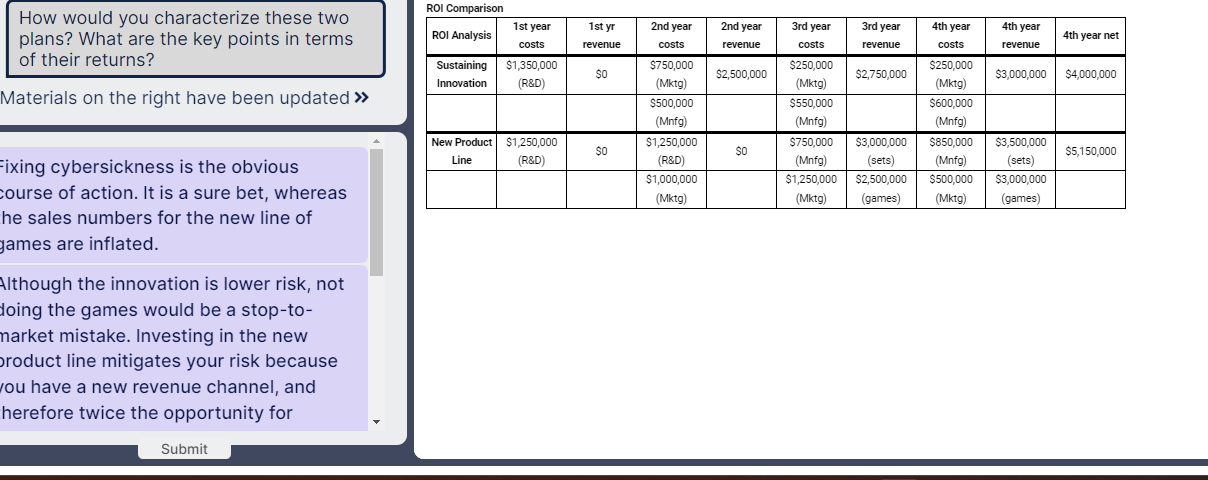

Question: How would you characterize these two plans? What are the key points in terms of their returns? Materials on the right have been updated >

How would you characterize these two plans? What are the key points in terms of their returns?

Materials on the right have been updated

ixing cybersickness is the obvious ourse of action. It is a sure bet, whereas he sales numbers for the new line of

tableROI Analysis,tablest yearcoststablest yrrevenuetablend yearcoststablend yearrevenuetablerd yearcoststablerd yearrevenuetableth yearcoststableth yearrevenueth year nettableSustainingInnovationtabletable$R&D$tabletable$Mktg$tabletable$Mktg$tabletable$Mktg$$tabletable$Mnfgtabletable$Mnfgtabletable MnfgtableNew ProductLinetabletable$R&D$tabletable$R&D$tabletable$$ Mnfgtabletable$setstabletableMnfgtabletable$sets$tabletable$Mktgtabletable$Mktgtabletable$gamestabletable$Mktgtabletable$games

yames are inflated.

Although the innovation is lower risk, not loing the games would be a stoptonarket mistake. Investing in the new oroduct line mitigates your risk because ou have a new revenue channel, and herefore twice the opportunity for

Submit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock