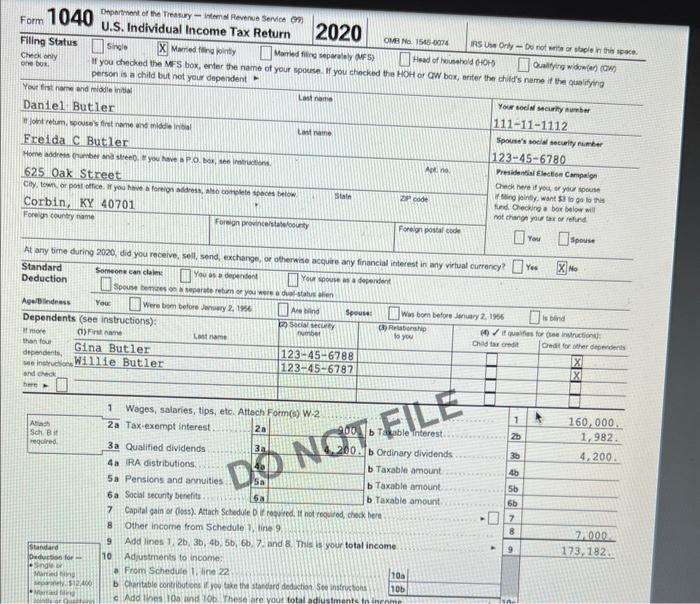

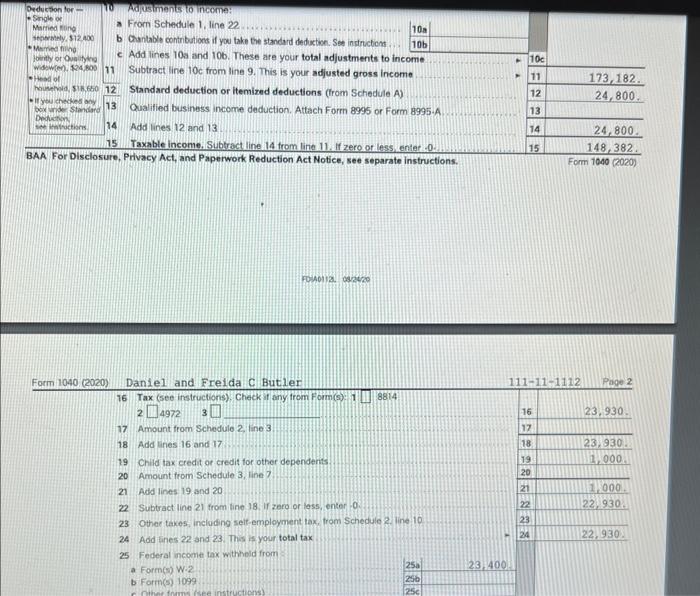

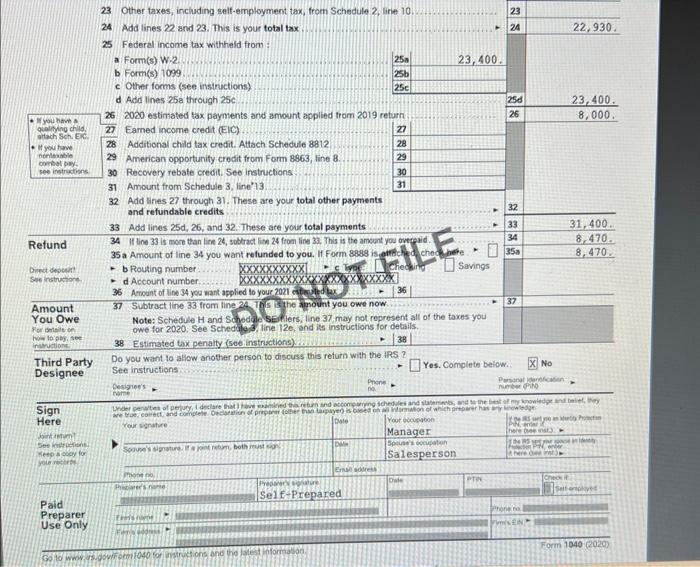

Question: How would you fill out the FORM 1040 using the information from the first photo? i attached an example of the 1040 of what lines

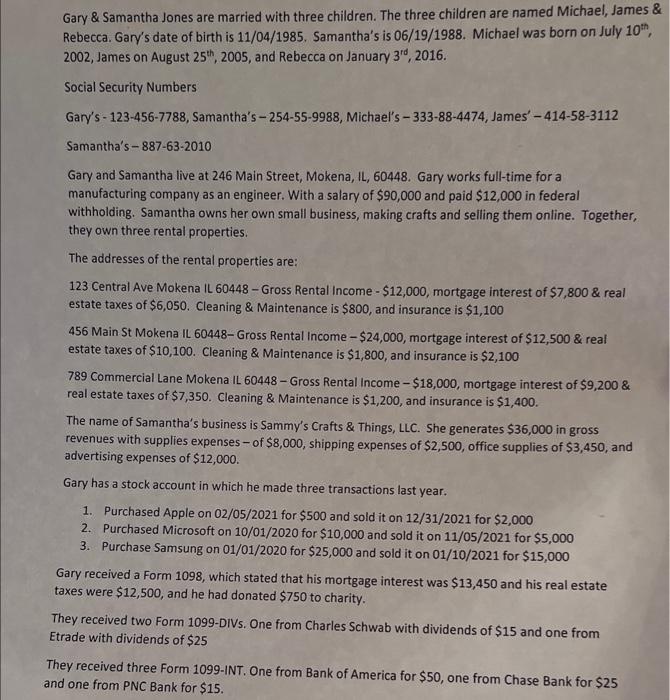

Gary \& Samantha Jones are married with three children. The three children are named Michael, James Rebecca. Gary's date of birth is 11/04/1985. Samantha's is 06/19/1988. Michael was born on July 10th, 2002 , James on August 25th,2005, and Rebecca on January 3rd,2016. Social Security Numbers Gary's - 123-456-7788, Samantha's - 254-55-9988, Michael's - 333-88-4474, James' - 414-58-3112 Samantha's - 887-63-2010 Gary and Samantha live at 246 Main Street, Mokena, IL, 60448. Gary works full-time for a manufacturing company as an engineer. With a salary of $90,000 and paid $12,000 in federal withholding. Samantha owns her own small business, making crafts and selling them online. Together, they own three rental properties. The addresses of the rental properties are: 123 Central Ave Mokena IL 60448 - Gross Rental Income - $12,000, mortgage interest of $7,800& real estate taxes of $6,050. Cleaning \& Maintenance is $800, and insurance is $1,100 456 Main St Mokena IL 60448-Gross Rental Income - $24,000, mortgage interest of $12,500& real estate taxes of $10,100. Cleaning \& Maintenance is $1,800, and insurance is $2,100 789 Commercial Lane Mokena IL 60448 - Gross Rental Income - $18,000, mortgage interest of $9,200 \& real estate taxes of $7,350. Cleaning \& Maintenance is $1,200, and insurance is $1,400. The name of Samantha's business is Sammy's Crafts \& Things, LLC. She generates $36,000 in gross revenues with supplies expenses - of $8,000, shipping expenses of $2,500, office supplies of $3,450, and advertising expenses of $12,000. Gary has a stock account in which he made three transactions last year. 1. Purchased Apple on 02/05/2021 for $500 and sold it on 12/31/2021 for $2,000 2. Purchased Microsoft on 10/01/2020 for $10,000 and sold it on 11/05/2021 for $5,000 3. Purchase Samsung on 01/01/2020 for $25,000 and sold it on 01/10/2021 for $15,000 Gary received a Form 1098, which stated that his mortgage interest was $13,450 and his real estate taxes were $12,500, and he had donated $750 to charity. They received two Form 1099-DIVs. One from Charles Schwab with dividends of $15 and one from Etrade with dividends of $25 They received three Form 1099-INT. One from Bank of America for $50, one from Chase Bank for $25 and one from PNC Bank for $15. Yout ens naree and middie ninial Dandel But ler Frelda C Butler BAA. For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separse Form 1040(2020) Daniel and Freida C Butler 16 Tax (see instructions), Check if any from Fom(s) 1 249723 17 Amount from Schedule 2, line 3. 18 Add lines 16 and 17 . 19 Child tax credit or credit for other dependents. 20 Amount from Schedule 3, line? 27 Add lines 19 and 20 22 Subtract line 21 from tine 18 . If zaro or less, enter. 0 . 23 Other taxes, including seif-employment tax, trom Schedule 2, line 10 . 24 Add anes 22 and 23. Thws is your total tax 111-11-1112||Page 2 25 Federal incomet tax withheid froms a Form(s) W.2 b Farm(s) 1099. 23 Other taxes, including self-employment tax, from Schedule 2, line 10. 24 Add lines 22 and 23 . This is your total tax 25 Federal income tax withheld from: a Form(s) w.2. b Form(s) 1099 . c Other forms (see instructions) d Add lines 25 a through 25c. Third Party Do you want to allow another person to discuss this refurn with the IRS ? Designee See instructions Yes. Complete below., X. No Gary \& Samantha Jones are married with three children. The three children are named Michael, James Rebecca. Gary's date of birth is 11/04/1985. Samantha's is 06/19/1988. Michael was born on July 10th, 2002 , James on August 25th,2005, and Rebecca on January 3rd,2016. Social Security Numbers Gary's - 123-456-7788, Samantha's - 254-55-9988, Michael's - 333-88-4474, James' - 414-58-3112 Samantha's - 887-63-2010 Gary and Samantha live at 246 Main Street, Mokena, IL, 60448. Gary works full-time for a manufacturing company as an engineer. With a salary of $90,000 and paid $12,000 in federal withholding. Samantha owns her own small business, making crafts and selling them online. Together, they own three rental properties. The addresses of the rental properties are: 123 Central Ave Mokena IL 60448 - Gross Rental Income - $12,000, mortgage interest of $7,800& real estate taxes of $6,050. Cleaning \& Maintenance is $800, and insurance is $1,100 456 Main St Mokena IL 60448-Gross Rental Income - $24,000, mortgage interest of $12,500& real estate taxes of $10,100. Cleaning \& Maintenance is $1,800, and insurance is $2,100 789 Commercial Lane Mokena IL 60448 - Gross Rental Income - $18,000, mortgage interest of $9,200 \& real estate taxes of $7,350. Cleaning \& Maintenance is $1,200, and insurance is $1,400. The name of Samantha's business is Sammy's Crafts \& Things, LLC. She generates $36,000 in gross revenues with supplies expenses - of $8,000, shipping expenses of $2,500, office supplies of $3,450, and advertising expenses of $12,000. Gary has a stock account in which he made three transactions last year. 1. Purchased Apple on 02/05/2021 for $500 and sold it on 12/31/2021 for $2,000 2. Purchased Microsoft on 10/01/2020 for $10,000 and sold it on 11/05/2021 for $5,000 3. Purchase Samsung on 01/01/2020 for $25,000 and sold it on 01/10/2021 for $15,000 Gary received a Form 1098, which stated that his mortgage interest was $13,450 and his real estate taxes were $12,500, and he had donated $750 to charity. They received two Form 1099-DIVs. One from Charles Schwab with dividends of $15 and one from Etrade with dividends of $25 They received three Form 1099-INT. One from Bank of America for $50, one from Chase Bank for $25 and one from PNC Bank for $15. Yout ens naree and middie ninial Dandel But ler Frelda C Butler BAA. For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separse Form 1040(2020) Daniel and Freida C Butler 16 Tax (see instructions), Check if any from Fom(s) 1 249723 17 Amount from Schedule 2, line 3. 18 Add lines 16 and 17 . 19 Child tax credit or credit for other dependents. 20 Amount from Schedule 3, line? 27 Add lines 19 and 20 22 Subtract line 21 from tine 18 . If zaro or less, enter. 0 . 23 Other taxes, including seif-employment tax, trom Schedule 2, line 10 . 24 Add anes 22 and 23. Thws is your total tax 111-11-1112||Page 2 25 Federal incomet tax withheid froms a Form(s) W.2 b Farm(s) 1099. 23 Other taxes, including self-employment tax, from Schedule 2, line 10. 24 Add lines 22 and 23 . This is your total tax 25 Federal income tax withheld from: a Form(s) w.2. b Form(s) 1099 . c Other forms (see instructions) d Add lines 25 a through 25c. Third Party Do you want to allow another person to discuss this refurn with the IRS ? Designee See instructions Yes. Complete below., X. No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts