Question: How would you work this problem pertaining to allocation overhead? 3. Actual overhead costs for this year were $165,845. Was overhead underapplied or over applied?

How would you work this problem pertaining to allocation overhead?

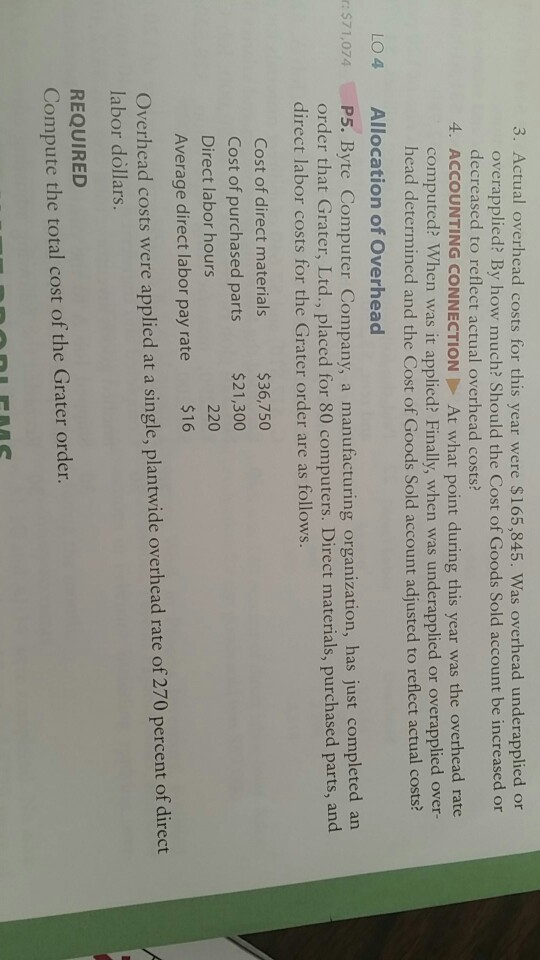

3. Actual overhead costs for this year were $165,845. Was overhead underapplied or over applied? By how much? Should the Cost of Goods Sold account be increased or decreased to reflect actual overhead costs? 4. AccoUNTING coNNECTION p At what point during this year was the overhead rate computed? When was it applied? Finally, when was underapplied or overapplied over- head determined and the Cost of Goods Sold account adjusted to reflect actual costs? LO 4 Allocation of Overhead $71,074 Byte Computer Company, a manufacturing organization, has just completed an order that Grater, Ltd., placed for 80 computers. Direct materials, purchased parts, and direct labor costs for the Grater order are as follows. Cost of direct materials $36,750 Cost of purchased parts $21,300 220 Direct labor hours Average direct labor pay rate $16 Overhead costs were applied at a single, plantwide overhead rate of 270 percent of direct labor dollars REQUIRED Compute the total cost of the Grater order

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts