Question: How write income statement and statement of financial position? including cost of sales and expenses You are helping Agned Ltd to prepare their accounts for

How write income statement and statement of financial position? including cost of sales and expenses

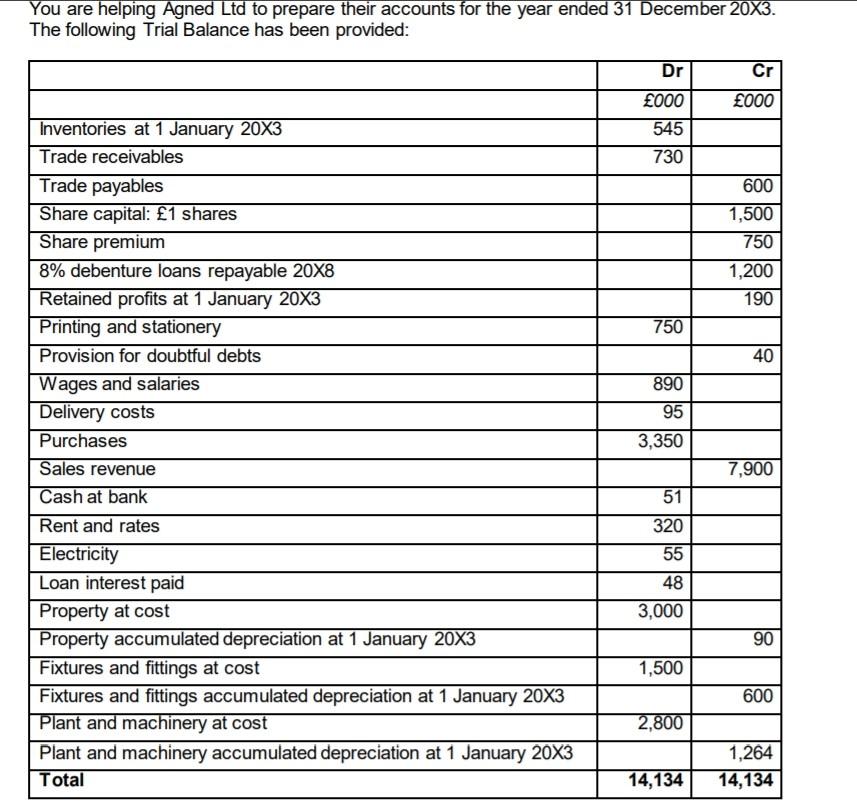

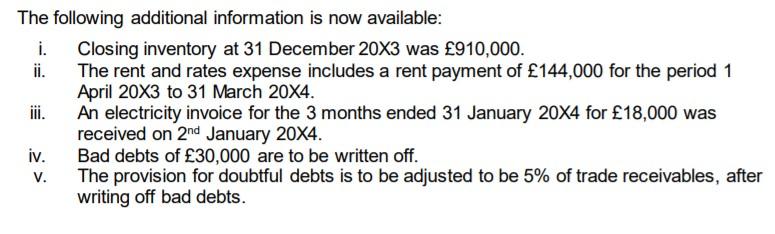

You are helping Agned Ltd to prepare their accounts for the year ended 31 December 20X3. The following Trial Balance has been provided: Dr Cr 000 000 545 730 600 1,500 750 1,200 190 750 40 890 95 3,350 Inventories at 1 January 20X3 Trade receivables Trade payables Share capital: 1 shares Share premium 8% debenture loans repayable 20X8 Retained profits at 1 January 20X3 Printing and stationery Provision for doubtful debts Wages and salaries Delivery costs Purchases Sales revenue Cash at bank Rent and rates Electricity Loan interest paid Property at cost Property accumulated depreciation at 1 January 20X3 Fixtures and fittings at cost Fixtures and fittings accumulated depreciation at 1 January 20X3 Plant and machinery at cost Plant and machinery accumulated depreciation at 1 January 20X3 Total 7,900 51 320 55 48 3,000 90 1,500 600 2,800 1,264 14,134 14,134 The following additional information is now available: i. Closing inventory at 31 December 20X3 was 910,000. ii. The rent and rates expense includes a rent payment of 144,000 for the period 1 April 20x3 to 31 March 20X4. An electricity invoice for the 3 months ended 31 January 20x4 for 18,000 was received on 2nd January 20X4. iv. Bad debts of 30,000 are to be written off. The provision for doubtful debts is to be adjusted to be 5% of trade receivables, after writing off bad debts. V. vi. Depreciation is to be charged for the year as follows: Property 2% per annum straight-line Fixtures and fittings 20% per annum straight-line Plant and machinery 25% per annum reducing balance The second instalment of the loan interest on debentures is outstanding at the year end. Corporation tax due to the tax authorities of 615,000 is to be accounted for. vii. v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts